the amount of garbage level scams related to real estate is off the charts it'd be nice if the jerkface republicans didn't continue attacking the consumer financial protection bureau CFPB www.banking.senate.gov/newsroom/maj...

I feel like 20 to 3o years from now the CFPB will be remembered as Democrats especially Warren's greatest achievement of that specific era probably even beyond Obamacare especially if we ever move beyond it.

Yeah, sure. Let Project 2025 dismantle NOAA, the FAA, the CFPB, etc., if Trump gets elected. What could go worng? digbysblog.net/2024/09/26/a...

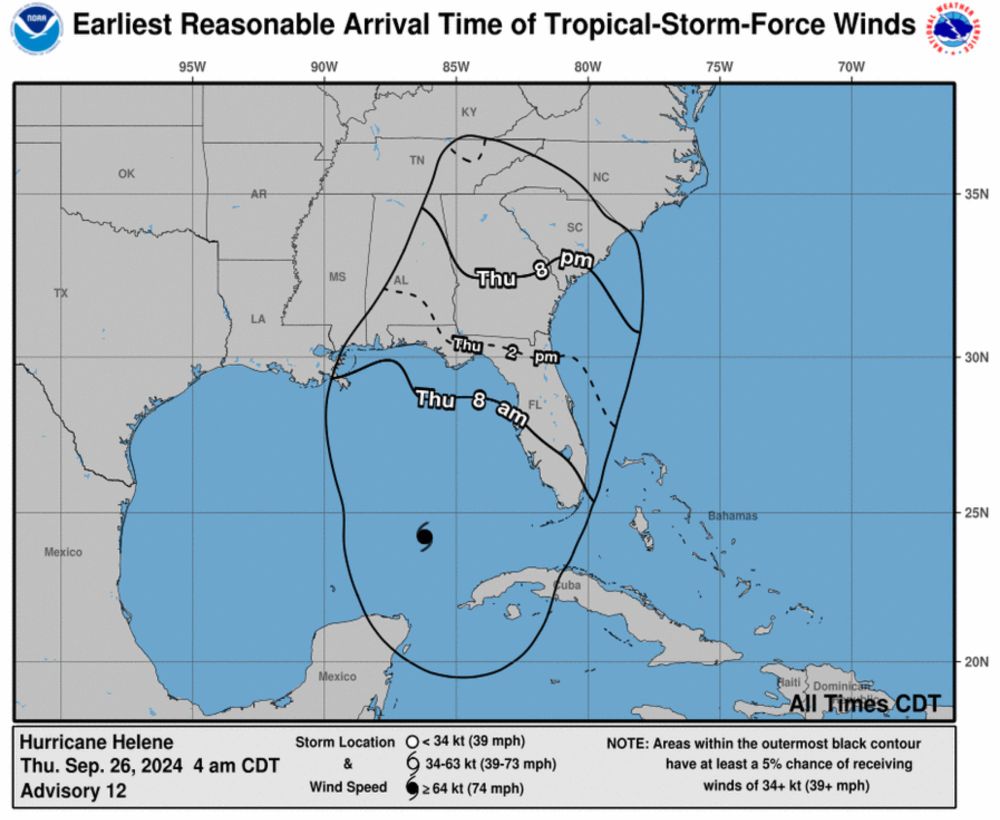

Project 2025 wants you caught by surprise Streets in low-lying areas here are already flooded and Hurricane Helene isn't even here yet. Public schools are closed preemtively. Emergency preparations ar...

3. US history is replete with bank runs, economic depressions, large scale fraud and regulatory capture. When those occurred, political pressure rose to fix which led to the FDIC, SEC, independent Federal Reserve, CFPB and a panoply of other acronymed organizations designed to...

Protip: CFPB is amazing Banks screwed me over with bullshit interest charges (that are illegal under the CARD act) & not giving earned bonuses 3 separate times 2/3x I got them to fix it immediately ONLY when I threatened to report them to the Consumer Finance Protection Bureau.

Until SCOTUS decides they're an unconstitutional agency like NLRB, FTC, CFPB, etc.Until SCOTUS decides they're an unconstitutional agency like NLRB, FTC, CFPB, etc.

It was such an honor to testify at the Senate Banking subcommittee hearing on private student loans earlier this week. I called on the CFPB to take a more hands-on approach, by creating a registry of firms, issuing 1022 orders & gathering court data. More here👇 banking.senate.gov/hearings/bac...

A Texas judge denied most of Colony Ridge Development's motion to dismiss a DOJ & CFPB lawsuit.

The government accused Colony Ridge of providing mortgage rates of 10.9-12.9% while the average prevailing rates of the time were around 2.4-4%, according to court documents.

I kinda felt the CFPB was duplicative, but the other agencies were so hidebound that they wouldn’t do everything they’re supposed to

I think it's more partitioned and tenured rather than duplicative, but it's definitely not innovative. It kinda holds the lane of "banking mechanics and processes" oversight. The Fed doesn't do as many AML/risk mgmt notices, nor does CFPB. In theory, these could all be streamlined/consolidated tho