Einfach 100% MSCI ACWI IMI oder FTSE All-World 🚬

can I suggest a couple more: 4. proposed merger between 7th and 11th biggest auditors (which leaves them in 7th place) 5. opinion piece calling on FTSE-100s to invite audits from outside Big 4

Und für alle, die es wieder ganz genau wissen wollen 🧐👇 🌎 Vanguard FTSE North America 🔢 ISIN IE00BKX55R35

Analis Jelaskan Kerugian Saham BREN Didepak dari Indeks FTSE Russell - https://kumparan.com/kumparanbisnis/analis-jelaskan-kerugian-saham-bren-didepak-dari-indeks-ftse-russell-23bAr7U91iR

Direktur Anugerah Mega Investama Hans Kwee menanggapi mengenai didepaknya saham PT Barito Renewable Energy Tbk (BREN) dari indeks FTSE Russell.#bisnisupdate #update #bisnis #text

Analis Jelaskan Kerugian Saham BREN Didepak dari Indeks FTSE Russell - https://kumparan.com/kumparanbisnis/analis-jelaskan-kerugian-saham-bren-didepak-dari-indeks-ftse-russell-23bAr7U91iR

Direktur Anugerah Mega Investama Hans Kwee menanggapi mengenai didepaknya saham PT Barito Renewable Energy Tbk (BREN) dari indeks FTSE Russell.#bisnisupdate #update #bisnis #text

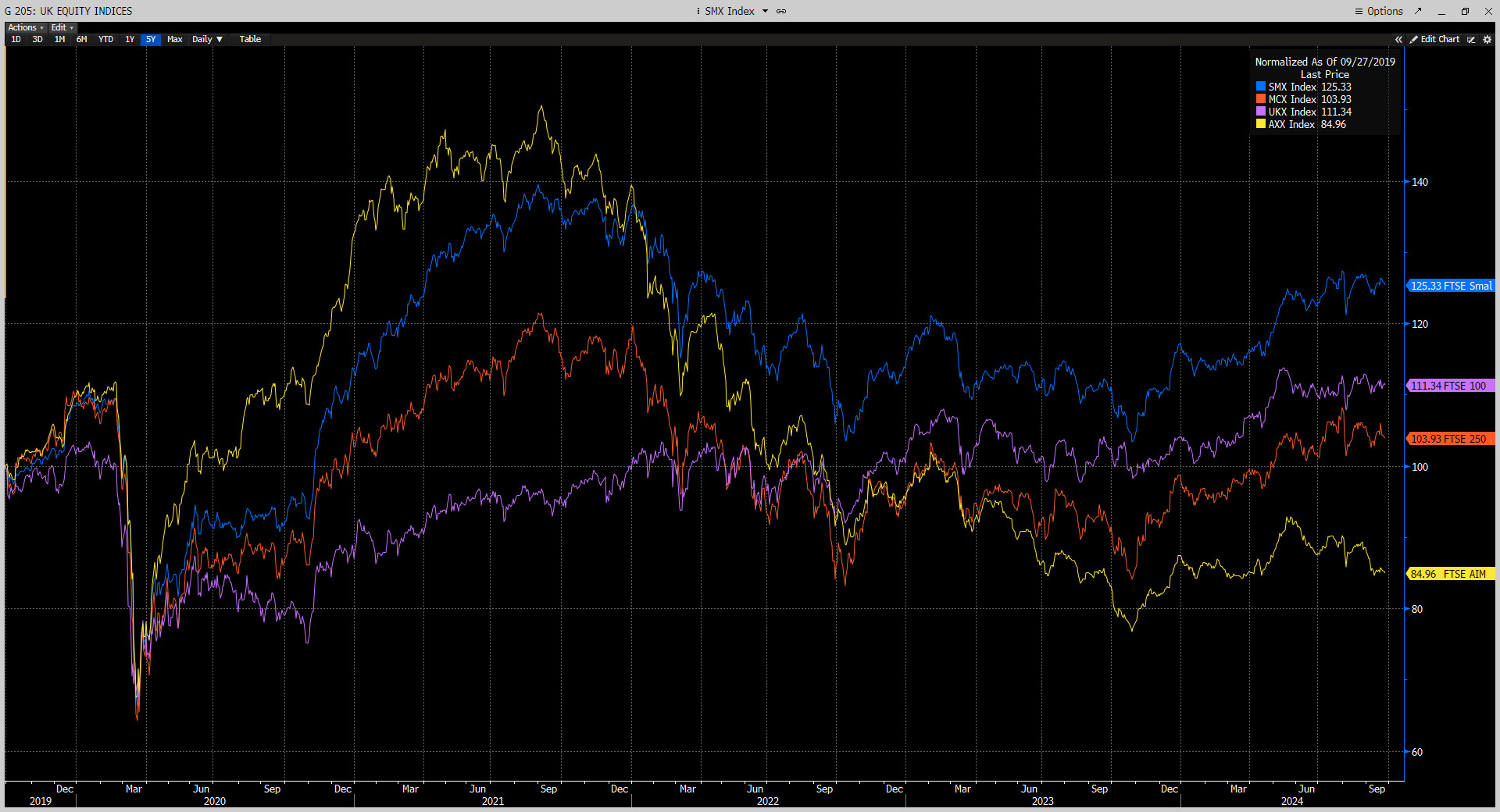

was looking at this earlier via a chat with @tobyn.bsky.social. the index is a material underperformer vs. FTSE Small Cap index (SMX), but there are some decent quality companies, which would be worth considering if there is a removal of beneficial tax treatment in the budget and commensurate hit:

at the risk of appearing cynical, removing the incentive to invest in AIM companies may well be good for investors' wealth. on a 5 year lookback since Covid, AIM has substantially underperformed FTSE Small Cap, 250 and 100: