BB

Benjamin Braun

@benbraun.bsky.social

Political economist @ LSE | Finance, central banking & more | benjaminbraun.org

1.6k followers385 following118 posts

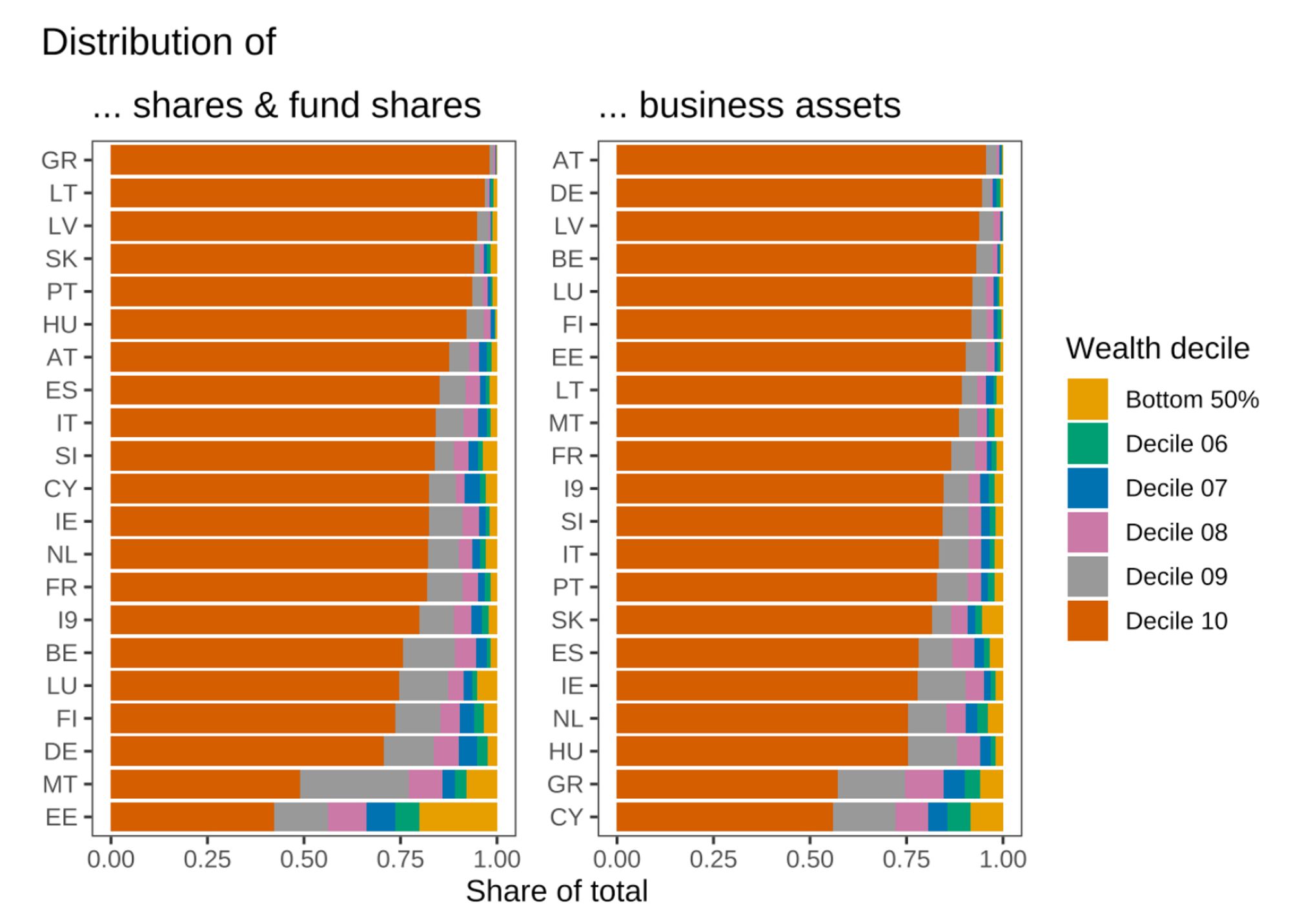

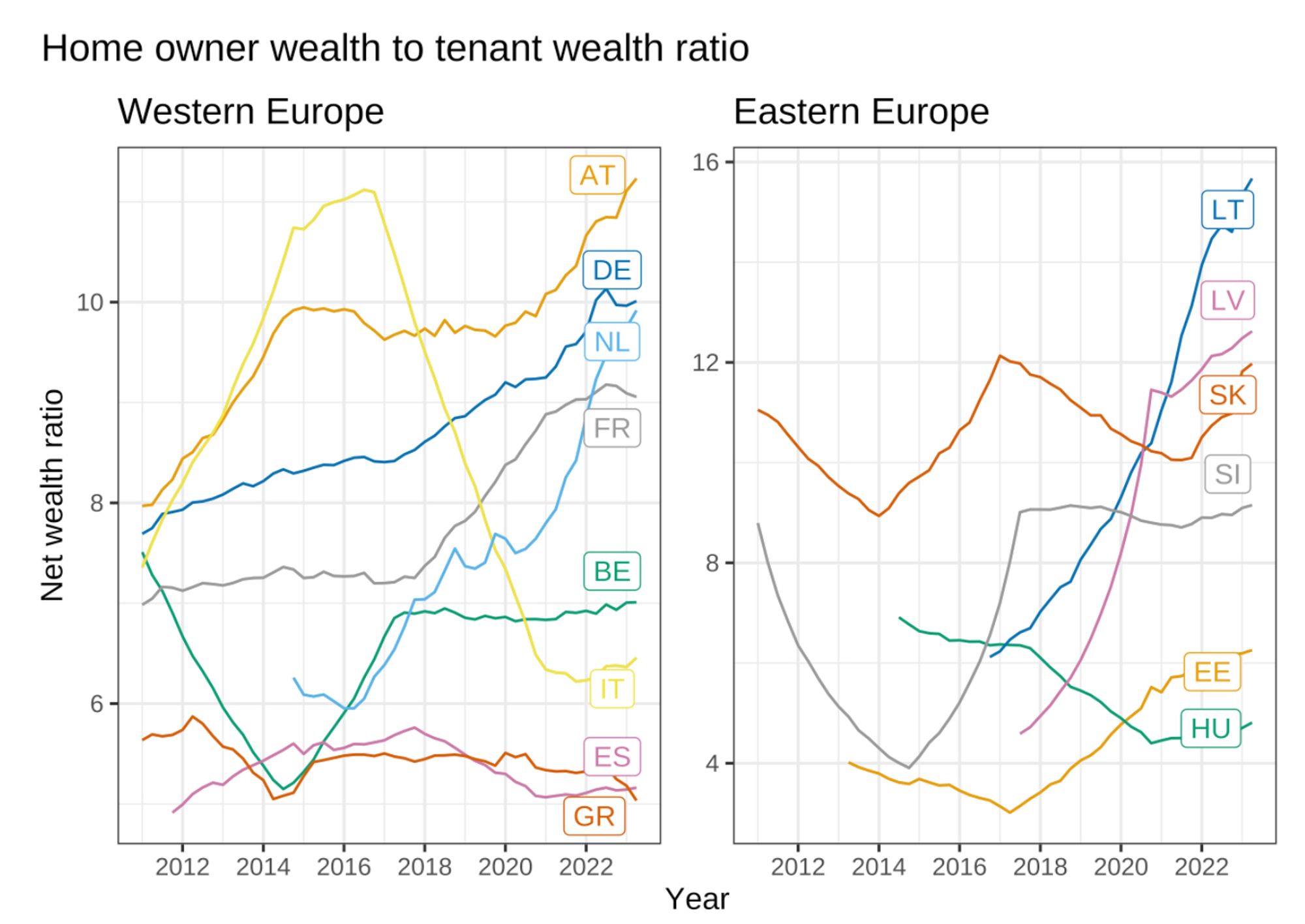

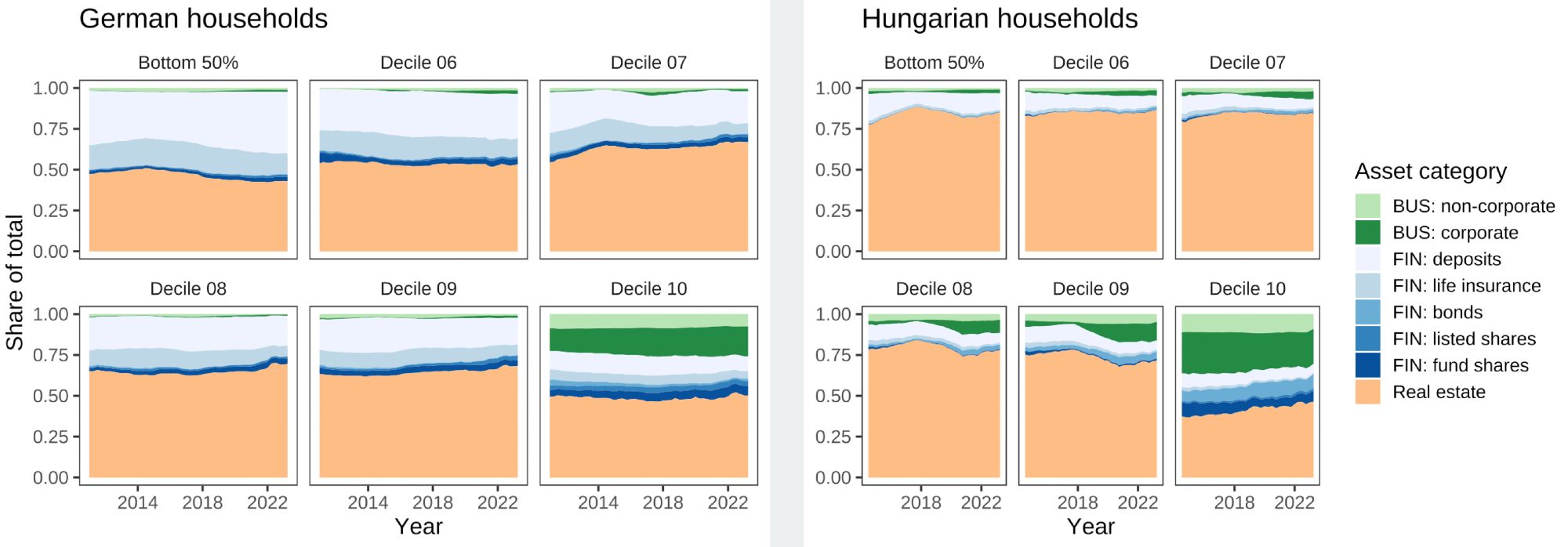

I wrote a post about the ECB's new distributional wealth accounts, which are a big deal. It explains what DWA are and shows what researchers can do with them. Highlights: - very unequal distribution of shares & business assets - massive home-owner/tenant wealth gap 1/3 benjaminbraun.org/posts/dwa/

The big disappointment: The DWA do not allow for granular breakdowns at the top of the wealth distribution. The top wealth group is the top decile, or the richest 10 per cent of households, meaning we can learn next to nothing about what is going on at the very top. 2/3

BB

Benjamin Braun

@benbraun.bsky.social

Political economist @ LSE | Finance, central banking & more | benjaminbraun.org

1.6k followers385 following118 posts