True, I ought to have added one!

There's a lot to like! Thanks for commenting.

You're welcome!

You can sign up for my newsletter here: eepurl.com/cHA0m9

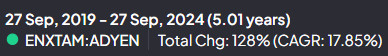

Final one. Dutch payment processing company Adyen (ADYEN), currently on a P/E of 53. Five years ago was on a P/E of 116. Even with a less than stellar three year performance has still returned nearly 18% annually in the last five years.

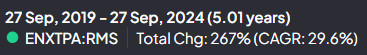

Out of the tech world, Hermes (RMS) shares much the same performance. P/E five years ago was much the same as it is today (mid-high 40's). It's returned 30% a year since.

I go where the value is! Hope you enjoy.

Shoe Zone PLC likewise, extremely cheap. But again, current liabilities of £30m, and £31m of inventory means that stuff better get sold!

Couldn't agree more, sir. So much less noise, and more genuine discussion.