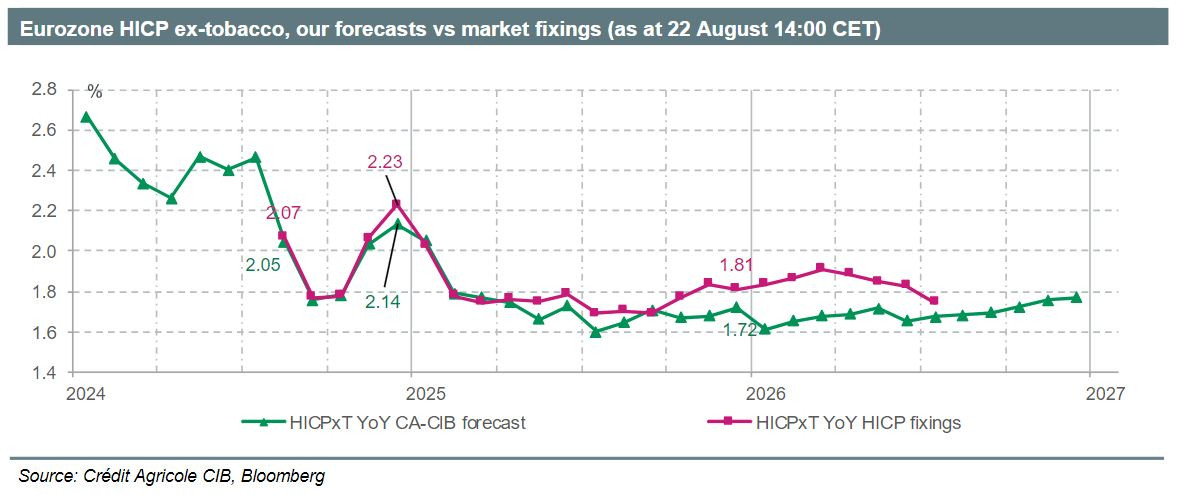

But a rapid decline in catch-up wage growth may not be required to bring euro area inflation back to target. Crédit Agricole’s forecast shows that there is a plausible scenario for euro area inflation to fall well below 2% by 2025, even if labour-intensive services inflation persists.

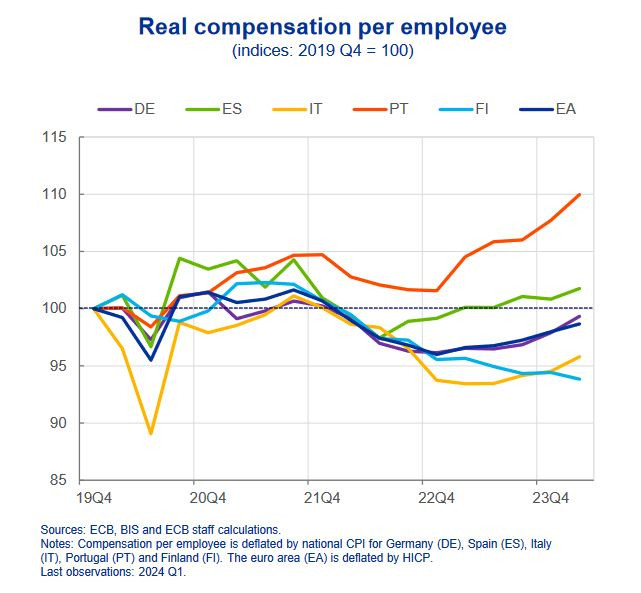

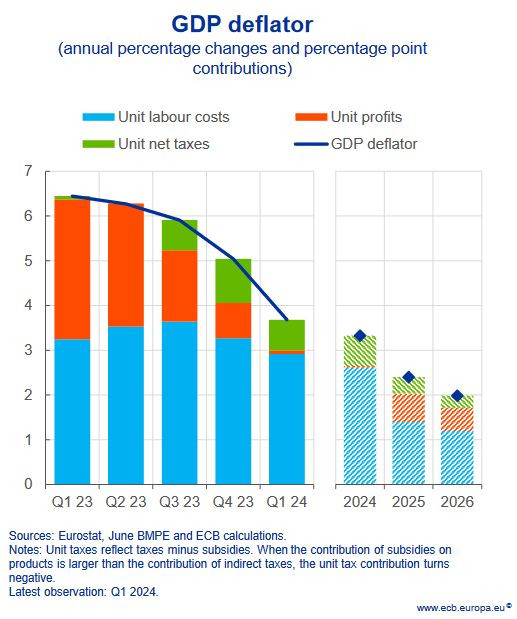

Isabel Schnabel argued that a timely return to 2% inflation in the euro area would require a sharp decline in corporate profit margins and less catch-up wage growth, and she asked whether real wages in Italy and Germany would remain well below pre-pandemic levels in the face of labour shortages.

Inflation fell to 2.2% y/y (2.8% core) in 🇪🇺 and to 2.0% y/y in 🇩🇪. In a speech in Tallinn on Friday, the ECB’s @isabelschnabel.bsky.socialwww.ecb.europa.eu/press/key/da...

Quick recap of last week's market developments. Equities were mixed (Europe up, US flat) and risk premia on corporate bonds fell slightly. Yields on 10y govt bonds rose by 6 bps in the US and by 4 bps in Germany, while implied policy rate cuts remained unchanged. As a result, yield curves steepened.

The speech was dovish. If the inflation spike was indeed nothing more than a fading bad dream, the Fed could cut rates by more than 200bp over the next year or two. The market's reaction to Powell was a slight decline in US yields and the dollar against the euro and some emerging market currencies.

Powell also didn't rule out faster rate cuts. He could have argued that the Fed should only lower rates gradually. Instead, he noted that "downside risks to employment have increased" and that "the timing and pace of rate reductions will depend on incoming data".

At no point in his speech did Powell refer to a structural rise in inflation. Rather, he argued that the inflation spike was due to excess demand and, from 2022, to pandemic-related supply shortages, and now his "confidence has grown that inflation is on a sustainable path back to 2 percent".

On Friday, Fed Chairman Powell spoke at Jackson Hole (www.federalreserve.gov/newsevents/s...). He argued that the Fed's rate hikes in 2022-2023 had stabilised inflation expectations. Now unemployment is rising and "we do not seek or welcome further cooling in labour market conditions", Powell said.

Four and a half years after COVID-19's arrival, the worst of the pandemic-related economic distortions are fading. Inflation has declined significantly. The la

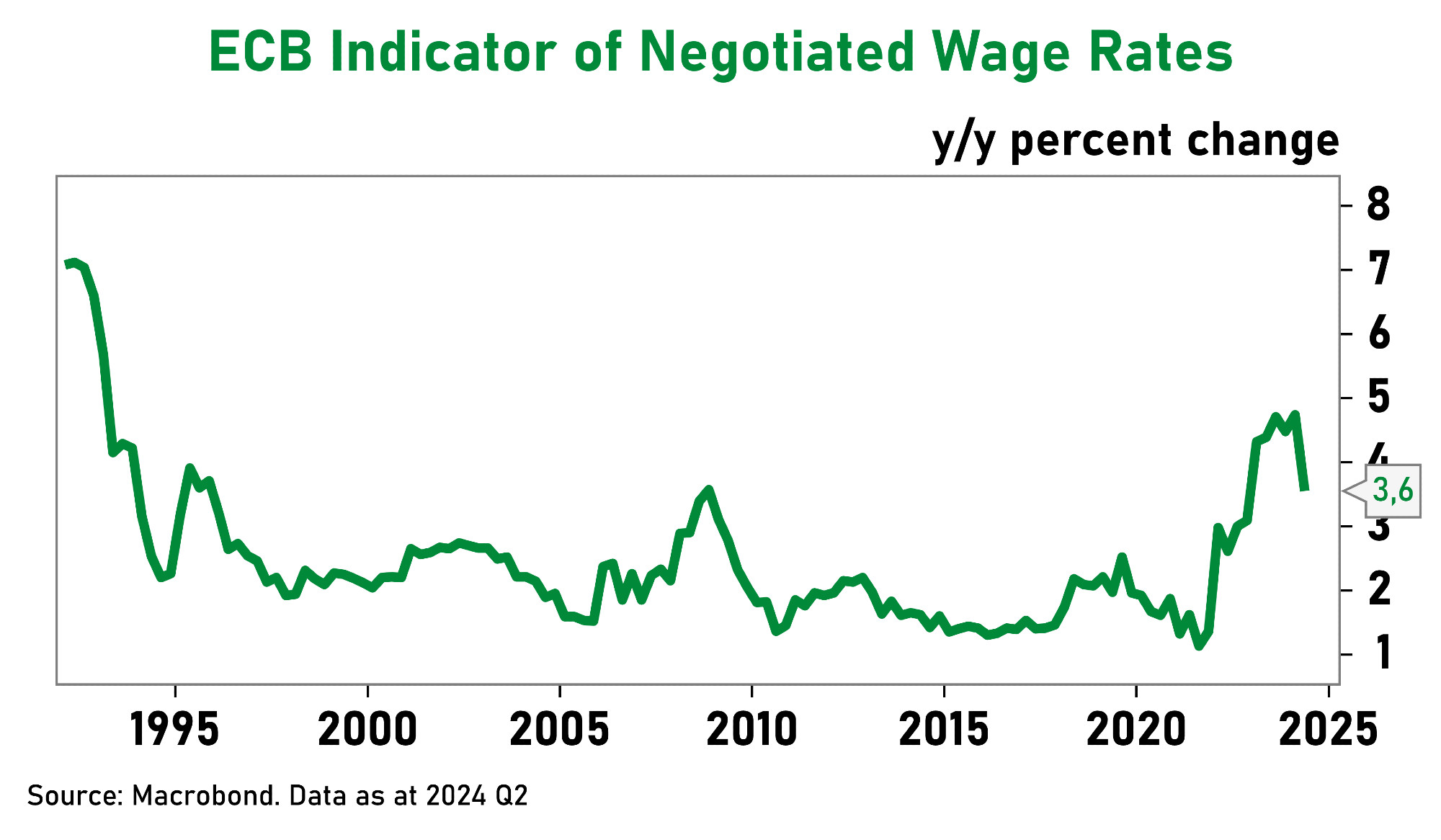

The German manufacturing PMI (which is less distorted by the Olympics than its French counterpart) came in well below expectations (48.5 vs. 49.3 exp). Eurozone wage growth slowed significantly to +3.6% y/y in Q2 2024 vs +4.7% in the previous quarter).

Quick of last week's market developments. Equity markets rose, credit market risk premia and government bond yields fell. US jobs data was revised down, with 818,000 fewer jobs created between April 2023 and March 2024 than originally reported.