So what’s the moral of this story? Don’t waste your precious time at university learning about business, finance and economic tools. Study stuff you will never have time to look at again, and learn how to learn. That should do to overcome most challenges in the workplace. (7/7)

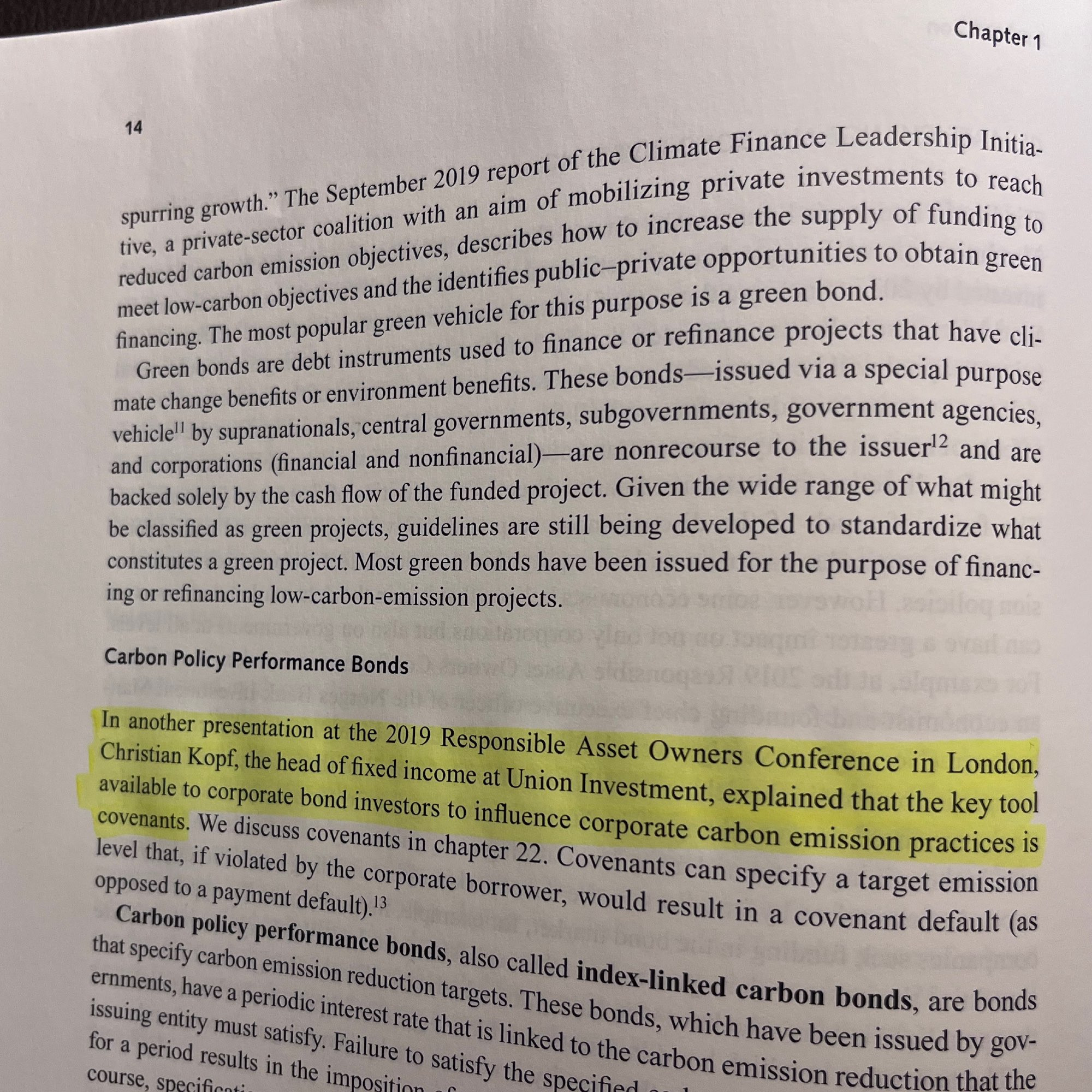

25 years later, I am teaching a course on fixed income portfolio management at the DVFA academy, and to prepare for class I bought the updated 10th edition of Fabozzi’s textbook. Only to find that Frank Fabozzi now cites me in Chapter 1 of his book as an expert on fixed income. (6/7)

I knew next to nothing about fixed income, but I was already managing the firm’s market exposure in 🇲🇽and 🇿🇦. So I bought Frank Fabozzi’s textbook, Bond Markets, Analysis and Strategy (3rd ed) and studied it on my way to work, on long winter evenings and in the pouring rain. (5/7)

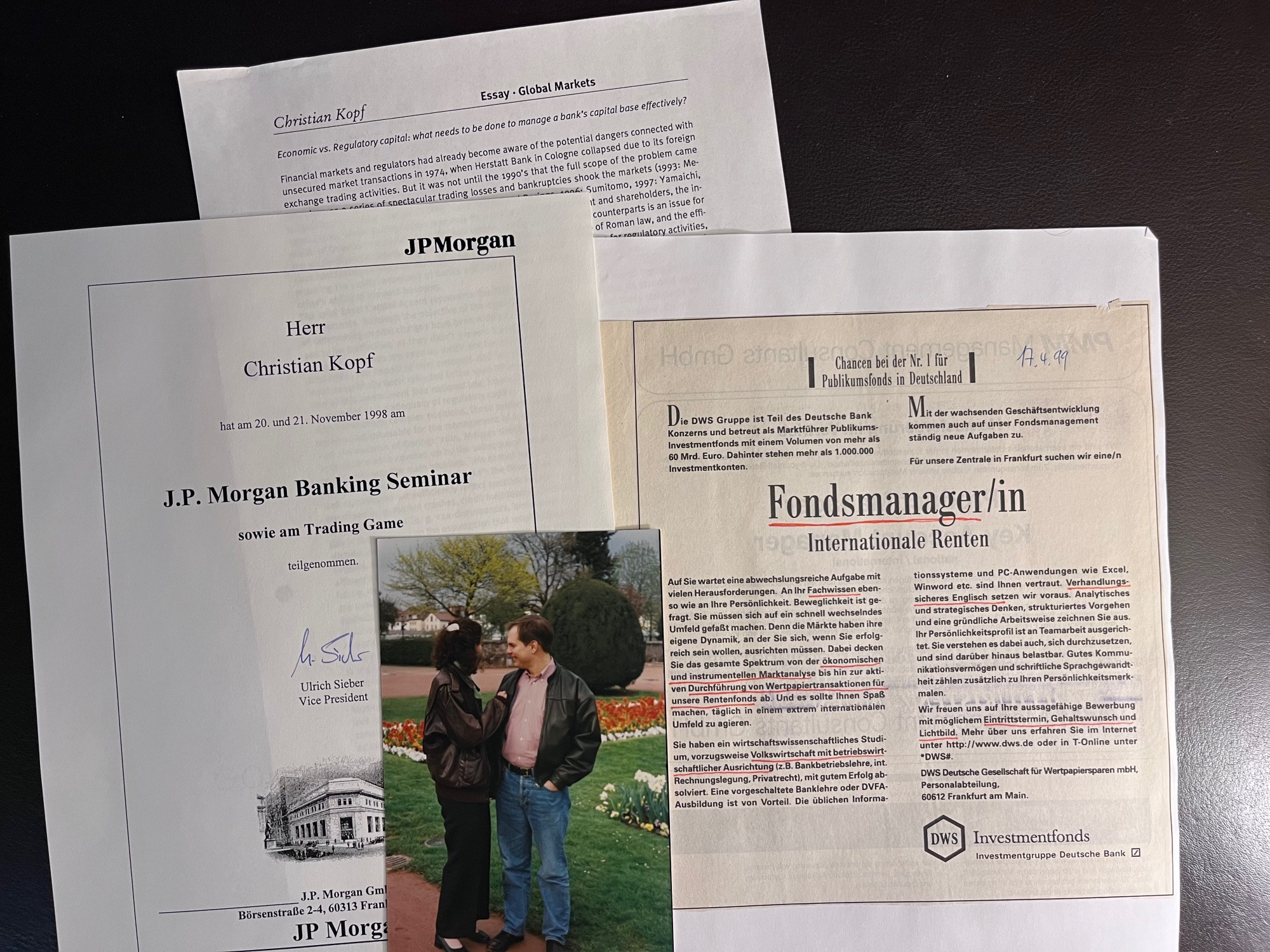

But after graduating, I wanted to move in with my then girlfriend and future wife, who lived near Frankfurt, so I looked for a job in finance. I attended JP Morgan’s banking seminar and landed a job as a fixed income portfolio manager at DWS. The first few months were tough. (4/7)

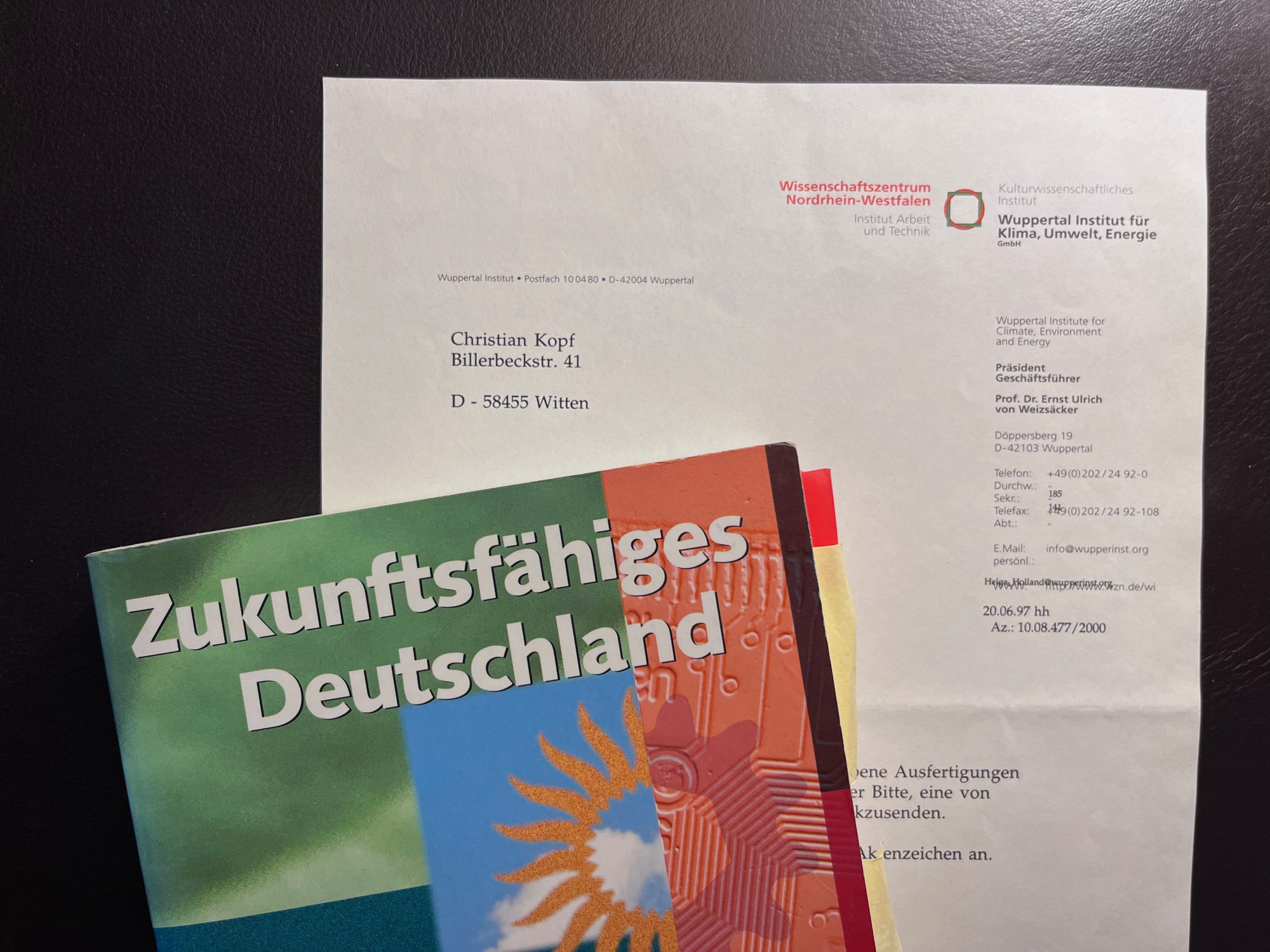

I also organised study trips to Mexico and Cuba and worked at the Wuppertal Institute for Climate, Environment and Energy, where I contributed to the study 'Zukunftsfähiges Deutschland', an early blueprint for the green transformation of the German economy. (3/7)

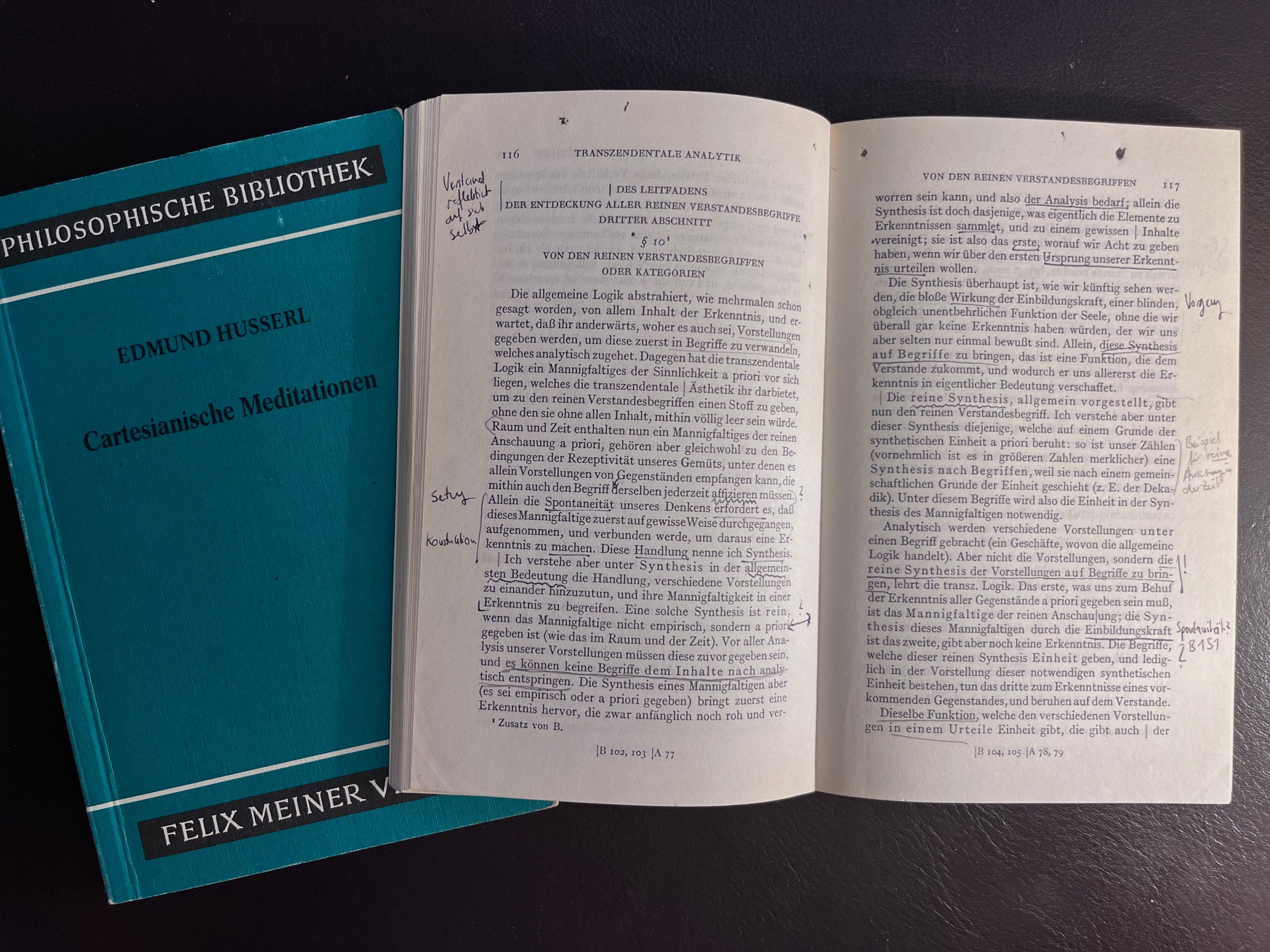

We read Kant and Husserl and met every Wednesday evening to discuss the Critique of Pure Reason with professors Edeltraud Priddat and Uwe an der Heiden. After several years we had finished § 24 of the first part and countless bottles of wine. (2/7)

On this day 25 years ago, I started working in the financial industry. I had studied economics at Witten/Herdecke University in Germany – where I spent most of my time doing other things. (1/7)

Next week, the US labour market report is on the agenda. If it turns out that the US economy has created significantly fewer than the 165,000 new jobs expected by the market in August, the Fed could decided to cut its policy rates by 50 bp instead of the widely expected 25 bp on September 18th.

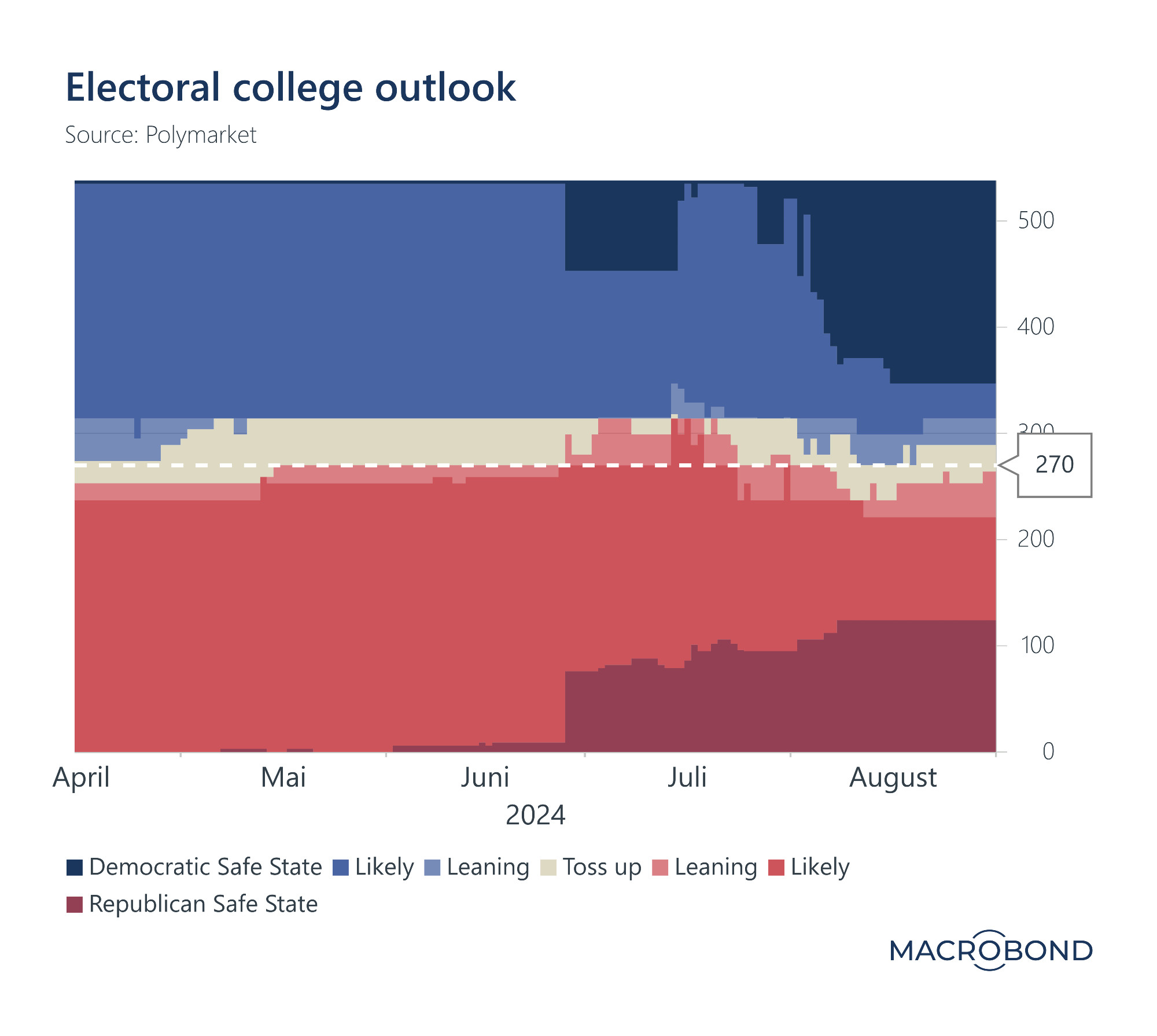

Meanwhile, the outcome of the US presidential election remains completely unclear, as the chart below shows – so there is not much point in betting on the extent of the Fed's interest rate cuts in 2025.

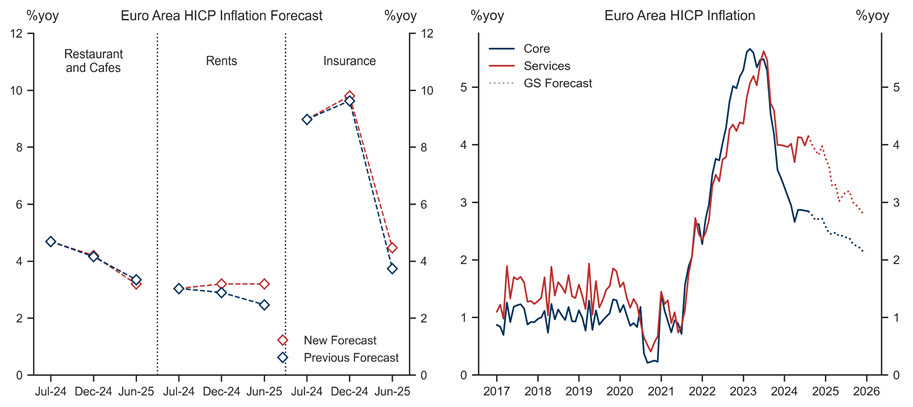

In Jean-François Perrin's model, core inflation falls below 2.0% in 2025, driven by base effects in “services with resets”, i.e. car insurance prices. Goldman Sachs also expects a significant decline in insurance inflation, which would help push core inflation down to 2.1% by the end of 2025.