Elon knows that Tesla can’t compete as a car company. As a tech company they own technology which is becoming less competitive. Ironically, if Ford are able to develop a leasing model like Apple does with new phones they are done.

If Ford buys Uber, Tesla will be F’d

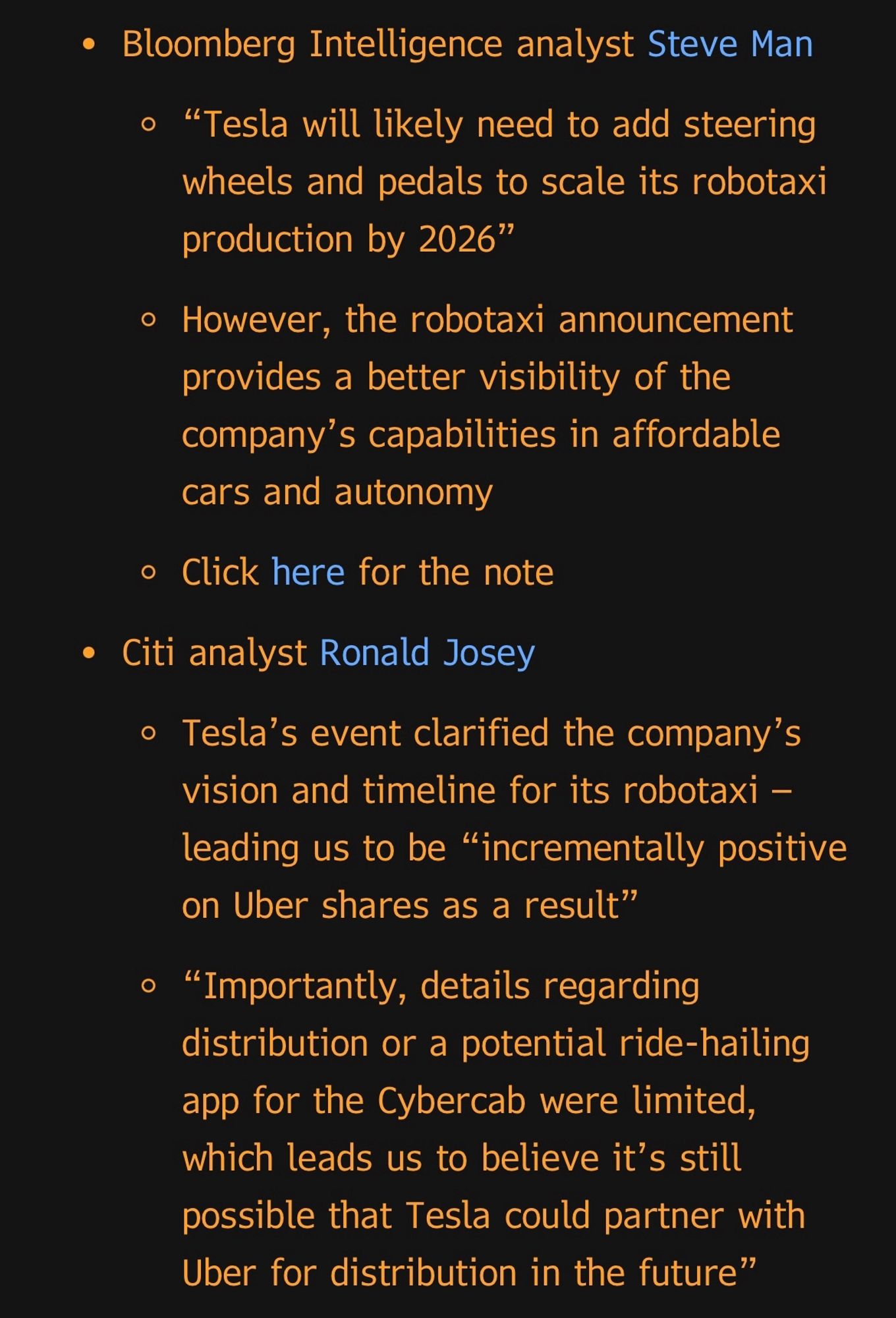

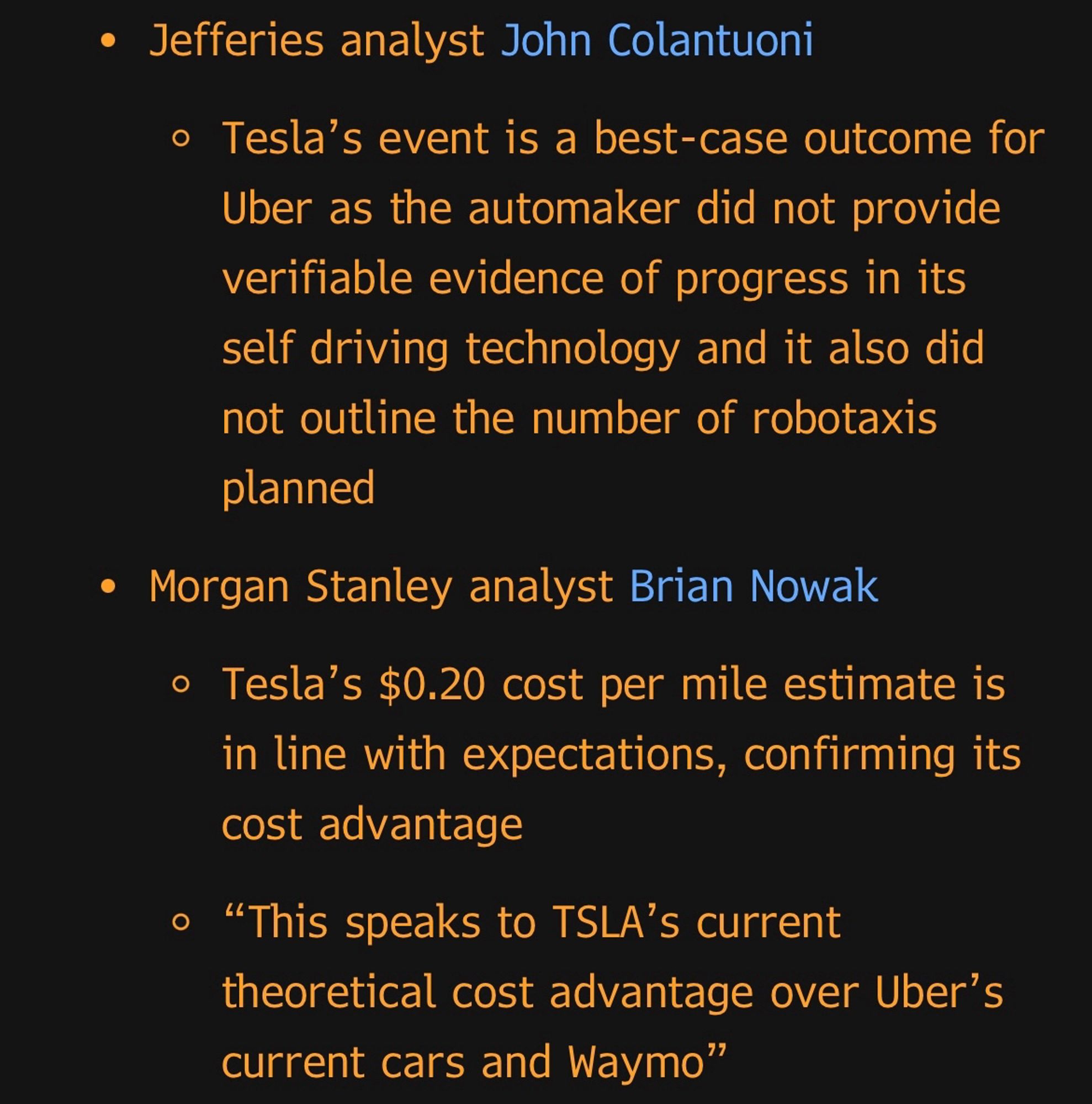

Only John got this right: Tesla didn’t show anything that can be proven or disproven. A tech demo of what they pinky swear they’ll deliver in 2026 is worthless; Musk lies about this stuff constantly and you’re a sucker if you take his word alone.

Love its "theoretical cost advantage."

george: Tesla's $0.20 cost per mile estimate is in line with expectations, confirming its cost advantage "This speaks to TSLA's current theoretical cost advantage over Uber's current cars and Waymo" tesla *claims* a cost per mile 'in line with expectations' so they have a cost advantage?

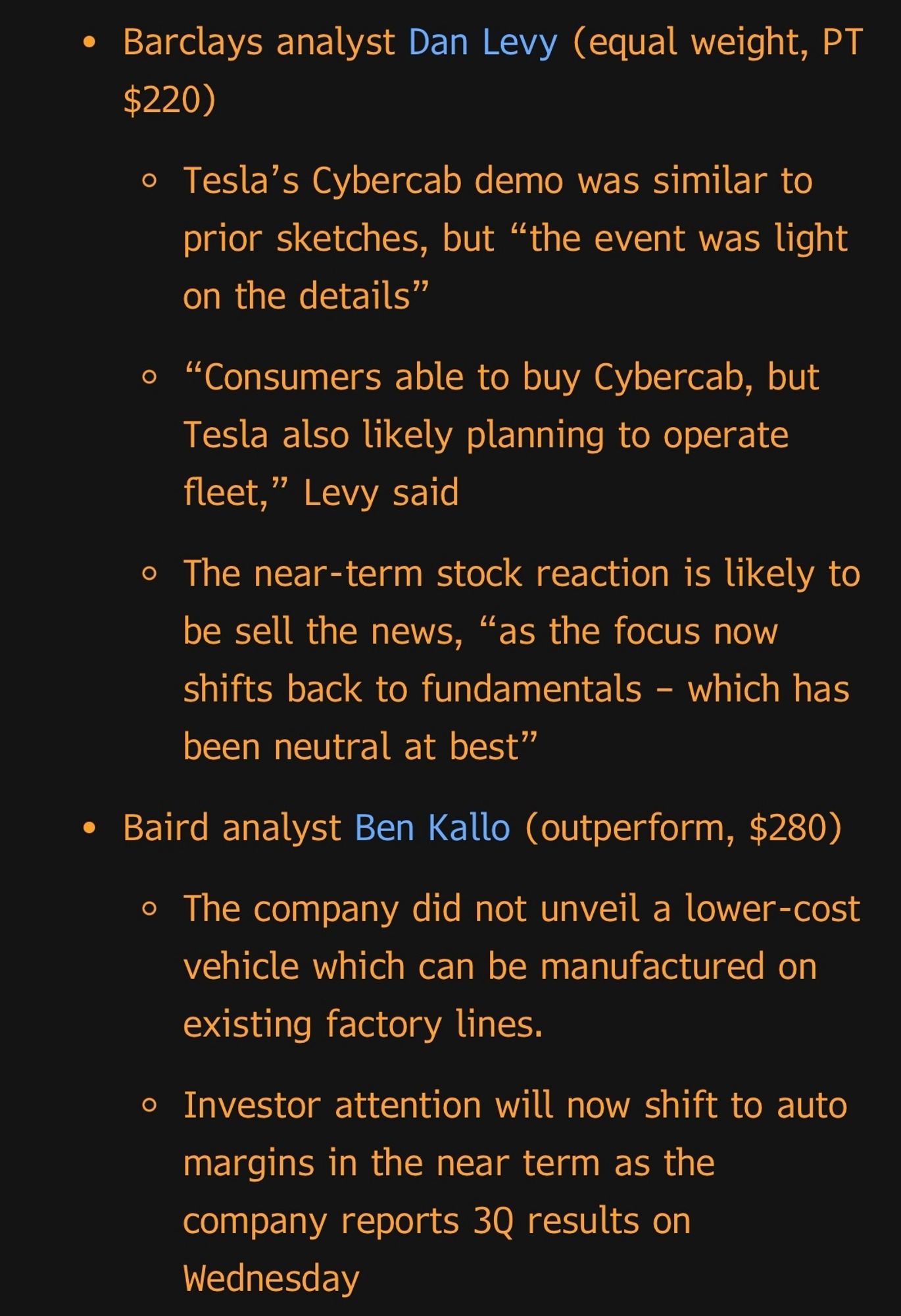

If you're wondering why the analysts who cover this stock are all so credulous about obviously ridiculous claims from Elon...self preservation is the first law of nature. Oh also, stock -5.5% pre-market so far.

Nothing like "current theoretical cost advantage" to get an investor excited

wait where is my Adam Jonas copium

Some of this is still so incongruous, like Baird guy who says this event is meaningless but still rates the stock as “outperform”