For a comprehensive view of the #cryptonativecryptonative.pwn.xyz/cryptonative... 🧵9/9 That's all folks. Thanks for reading and sharing ;)

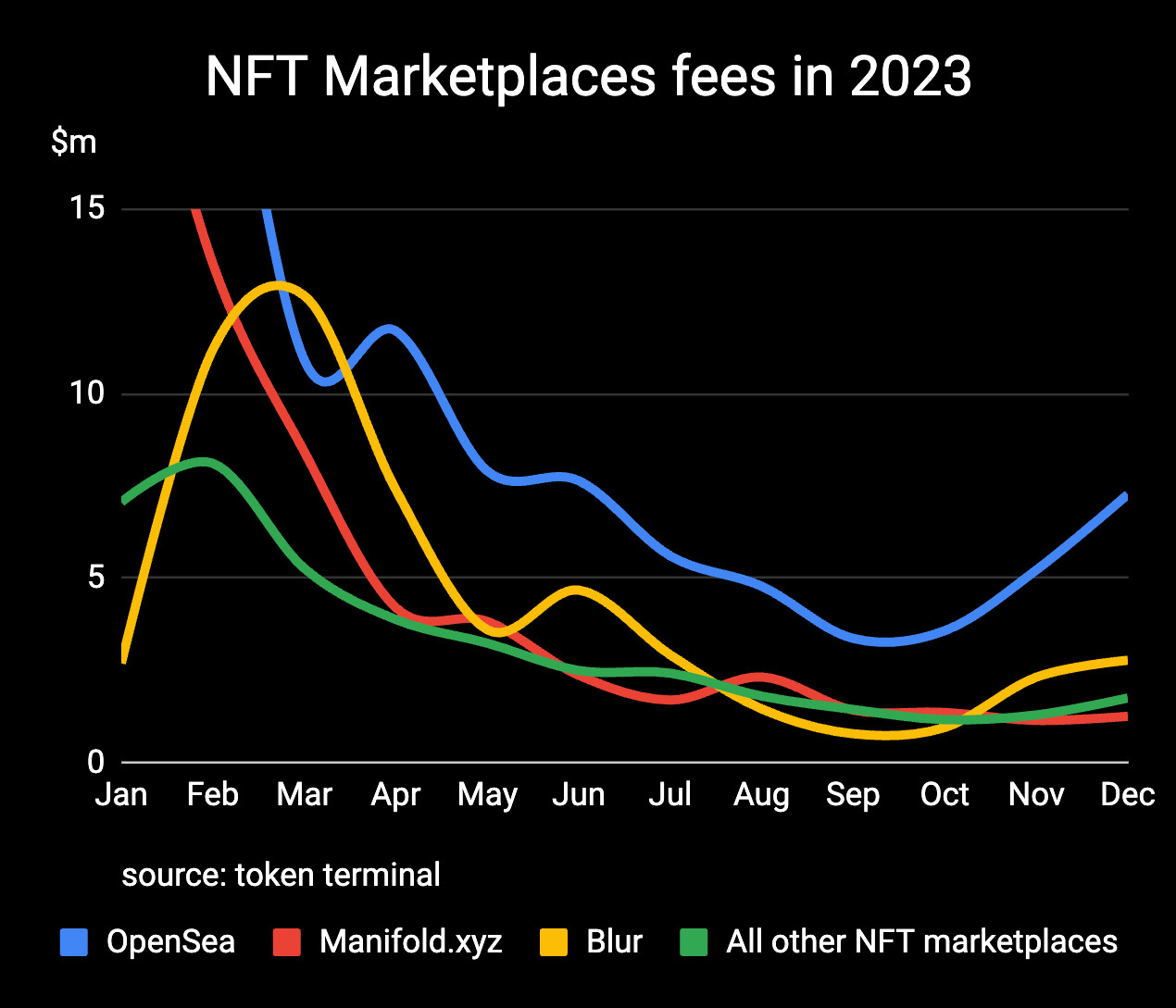

NFT Marketplaces faced an 87% plunge in fees, the steepest across all categories. Intriguingly, despite Blur's meteoric 2718% rise, Opensea maintained its lead, generating 238% more in fees, even after a 91% decrease. The Top3 is completed by Manifold, second in terms of fees generated. 🧵7/9

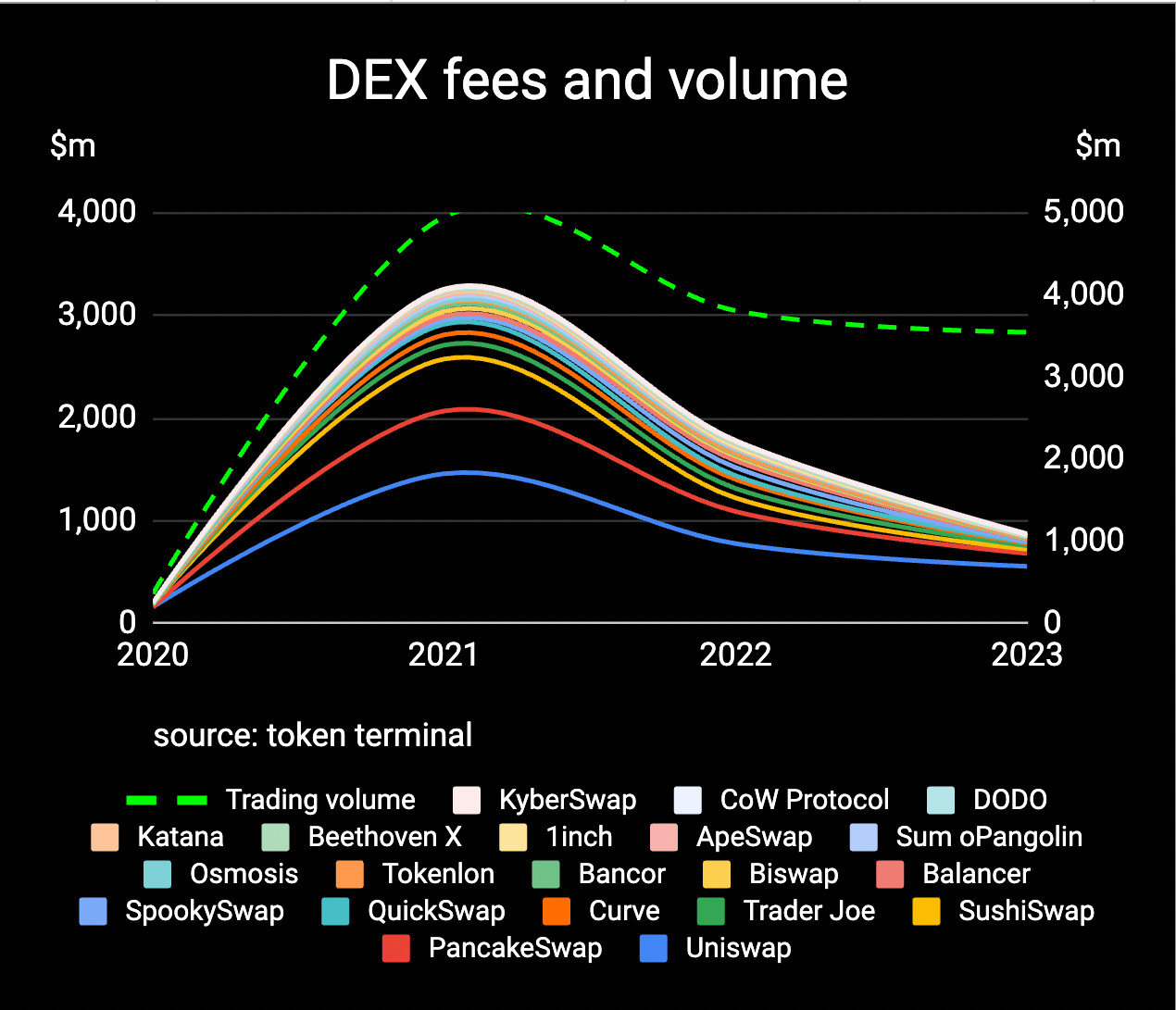

DEXs kept their transaction volume steady but saw a 51% reduction in fees, likely due to heightened competition and Layer 2 growth. @uniswap.org remains the dominant player in this more efficient and maturing market. Followed by PancakeSwap, SushiSwap, TraderJoe and Balancer rounding the Top5.🧵6/9

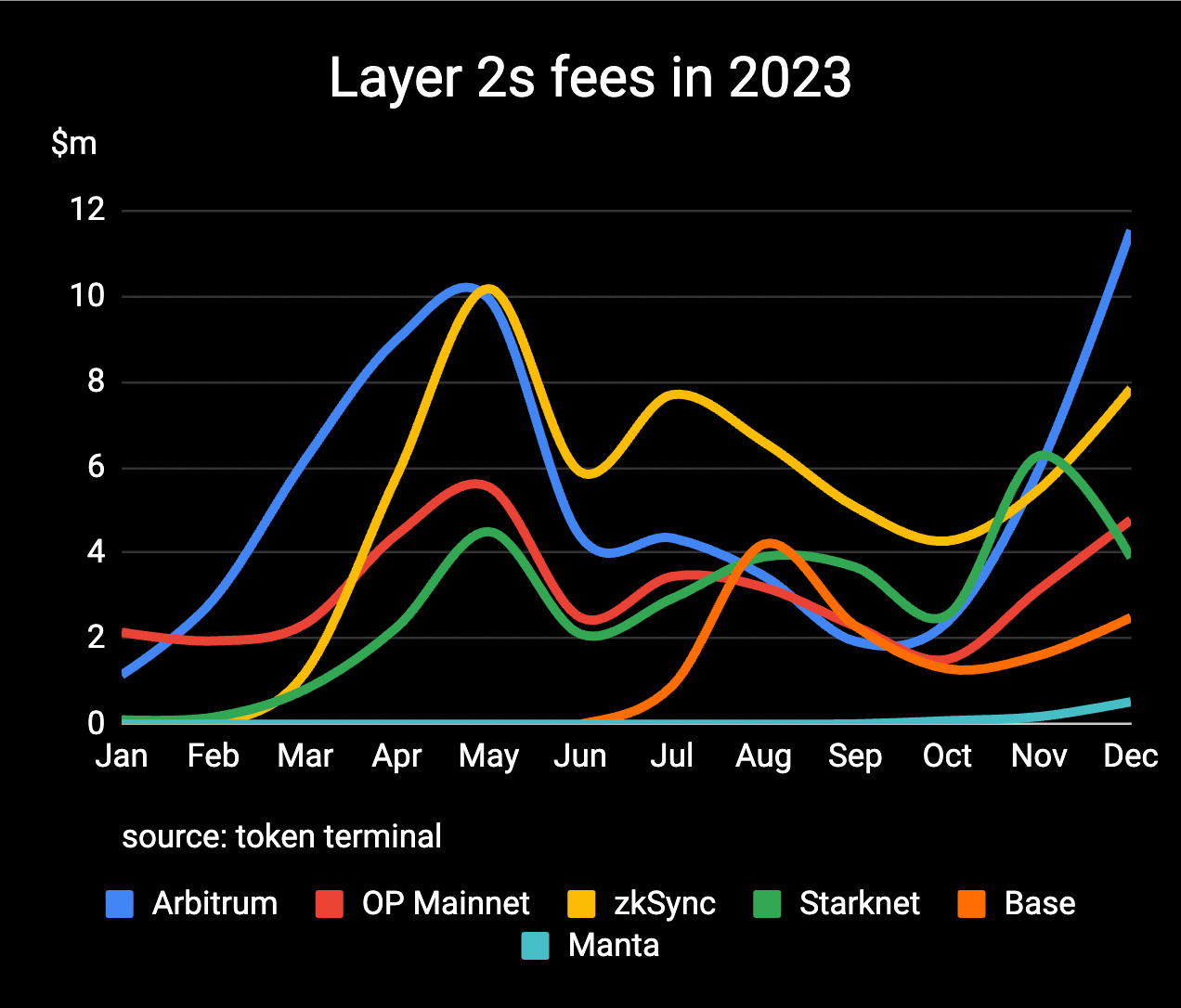

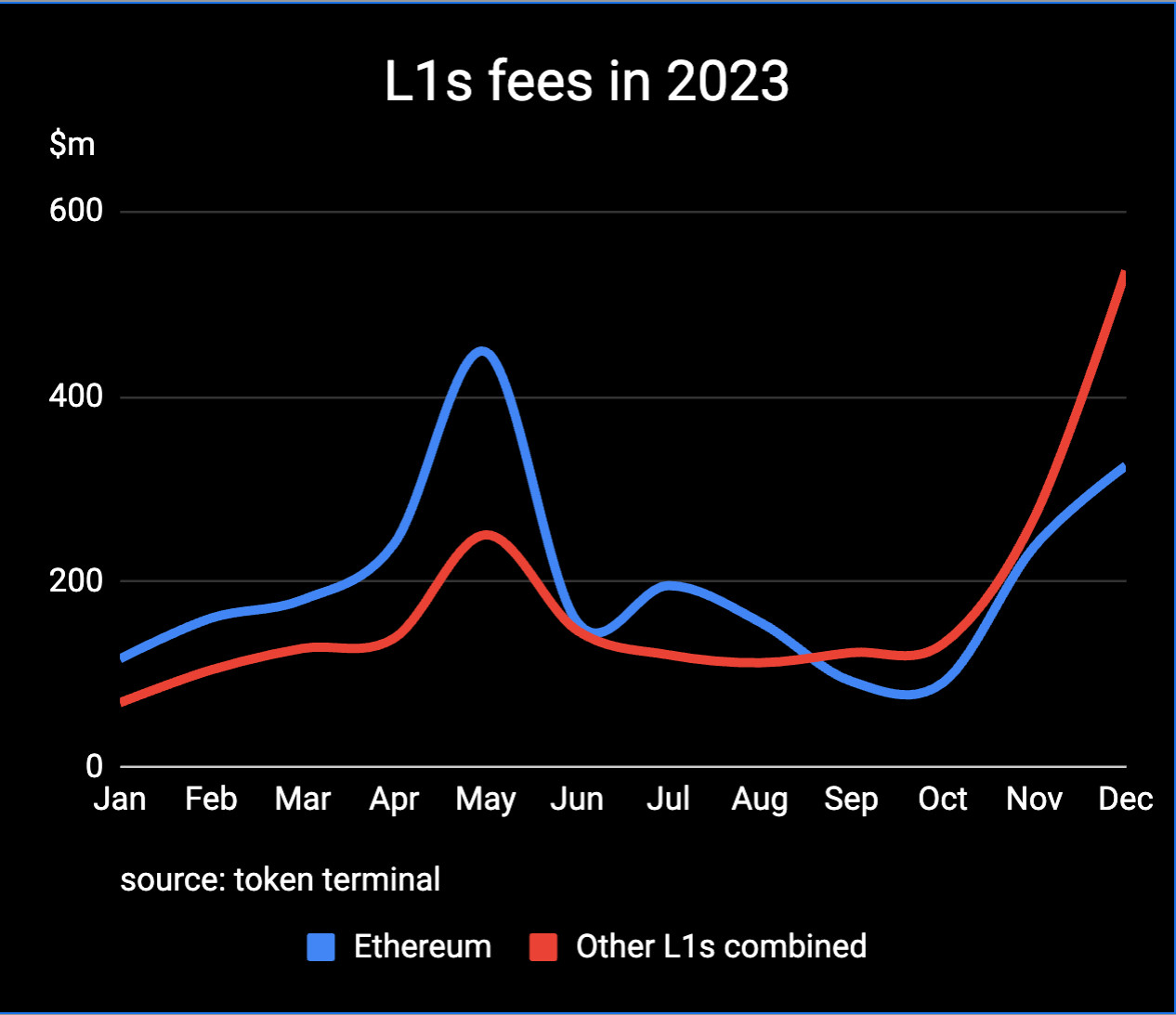

Layer 1s continue to lead, growing from 48% in 2022 to 59% of total fees in 2023. Ethereum was overtaken by other L1s combined in September. Tron's fees tripled amid a 23% rise in users. BTC fees spiked (ordinals), BNB Chain saw a reduction despite user growth. Ethereum maintained its user base.🧵3/9

PWN Token Bundler deep dive? Yes, please! x.com/pwndao/statu...