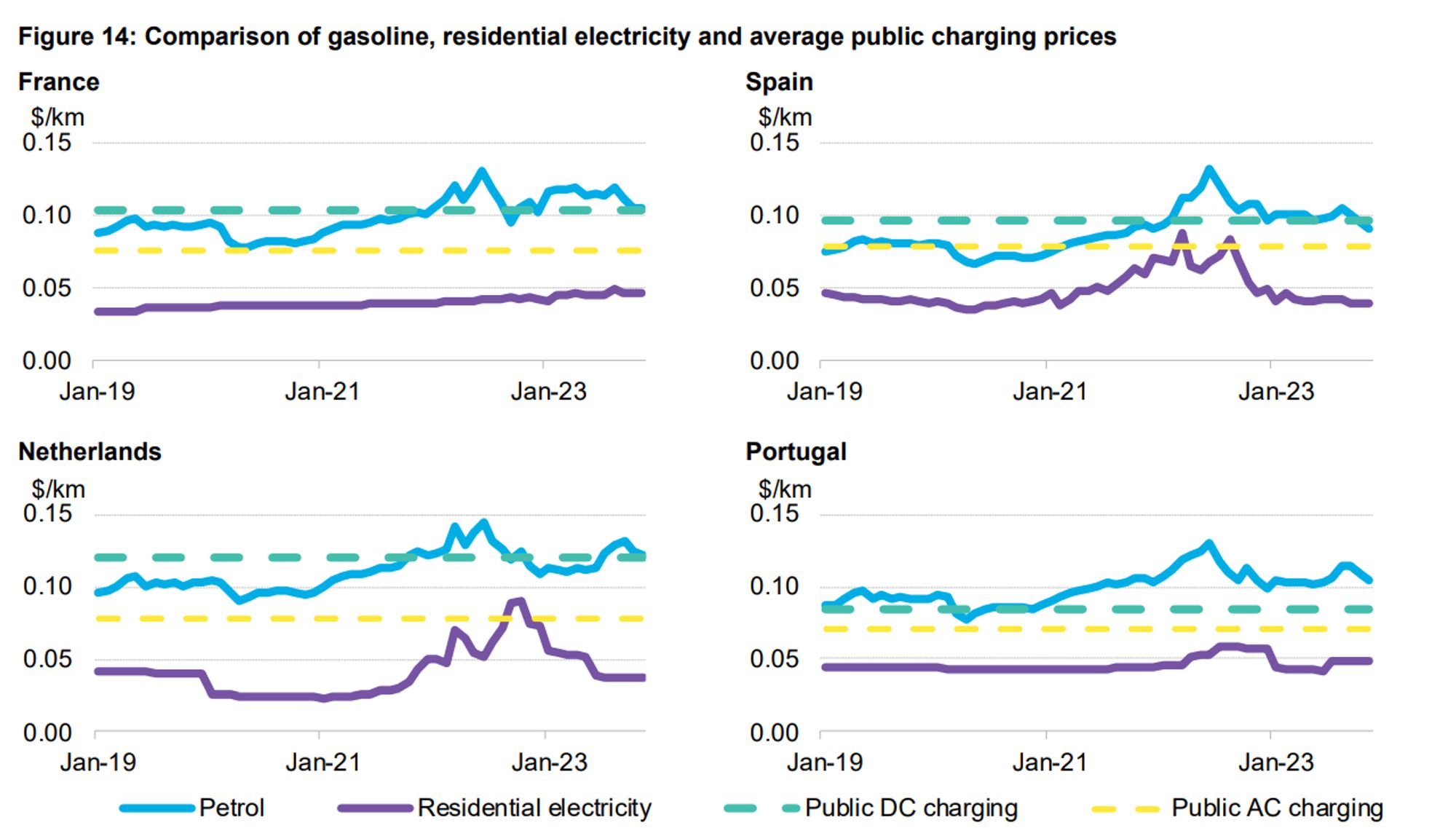

Charge point is installed this week so will drop out to a very rare user of public charging, at which point I will massively favour rock up and contactless banks of rapids, because convenience rules, and I'm happy to pay for it 🤷

As a newly minted EV driver, and still awaiting a home charge point installation, I'm in the honeymoon period of even thinking DC charging is cheap compared to petrol as you're charging £15/£20 per time rather than a £60-70 fill up. I know factually, this is not true on a $/km basis but it's nice.

Look at the residential electricity (purple) lines. Having a renationalised electricity supplier doesn't shield you from European energy crisis costs, it just allocates them differently.

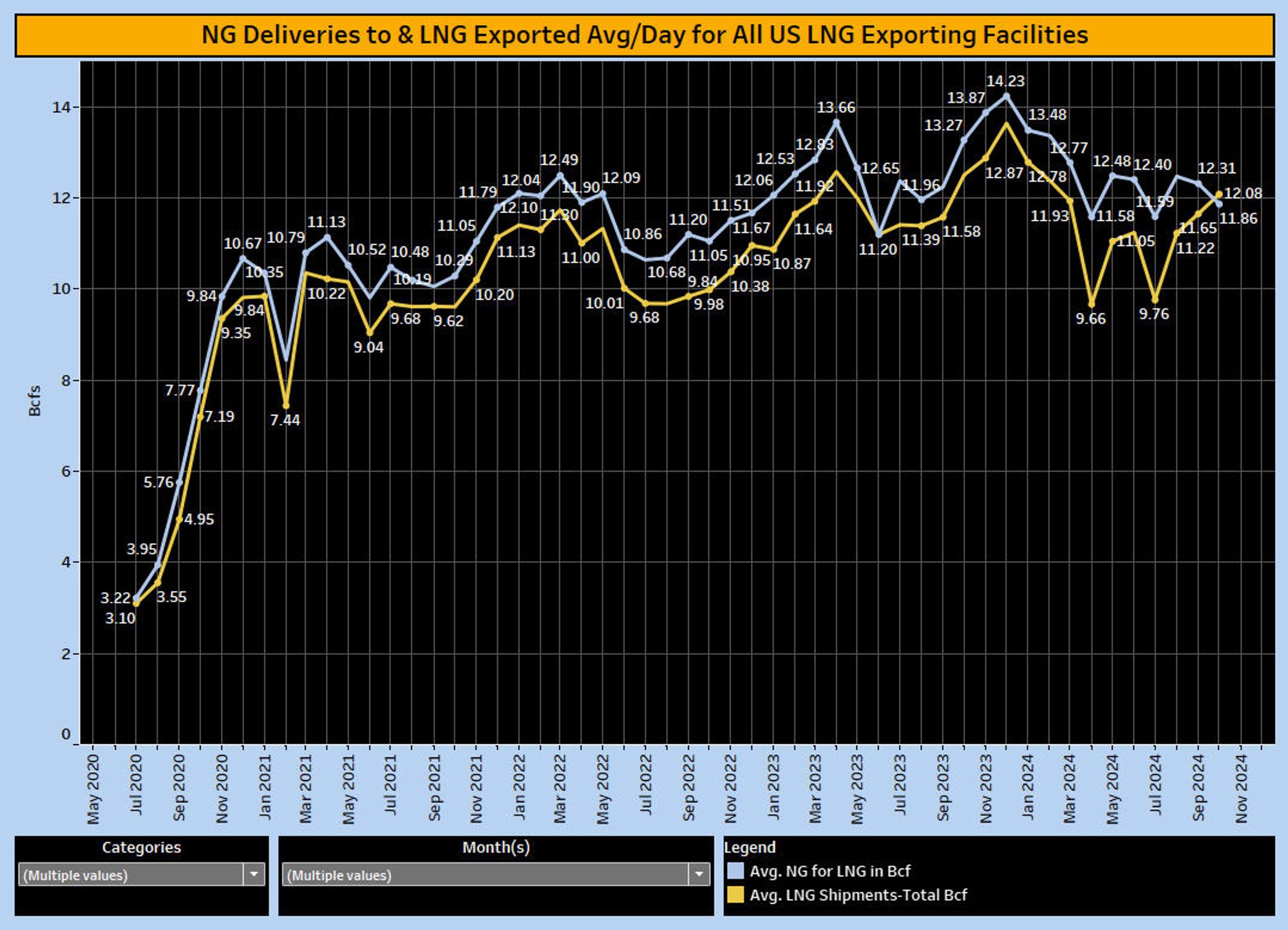

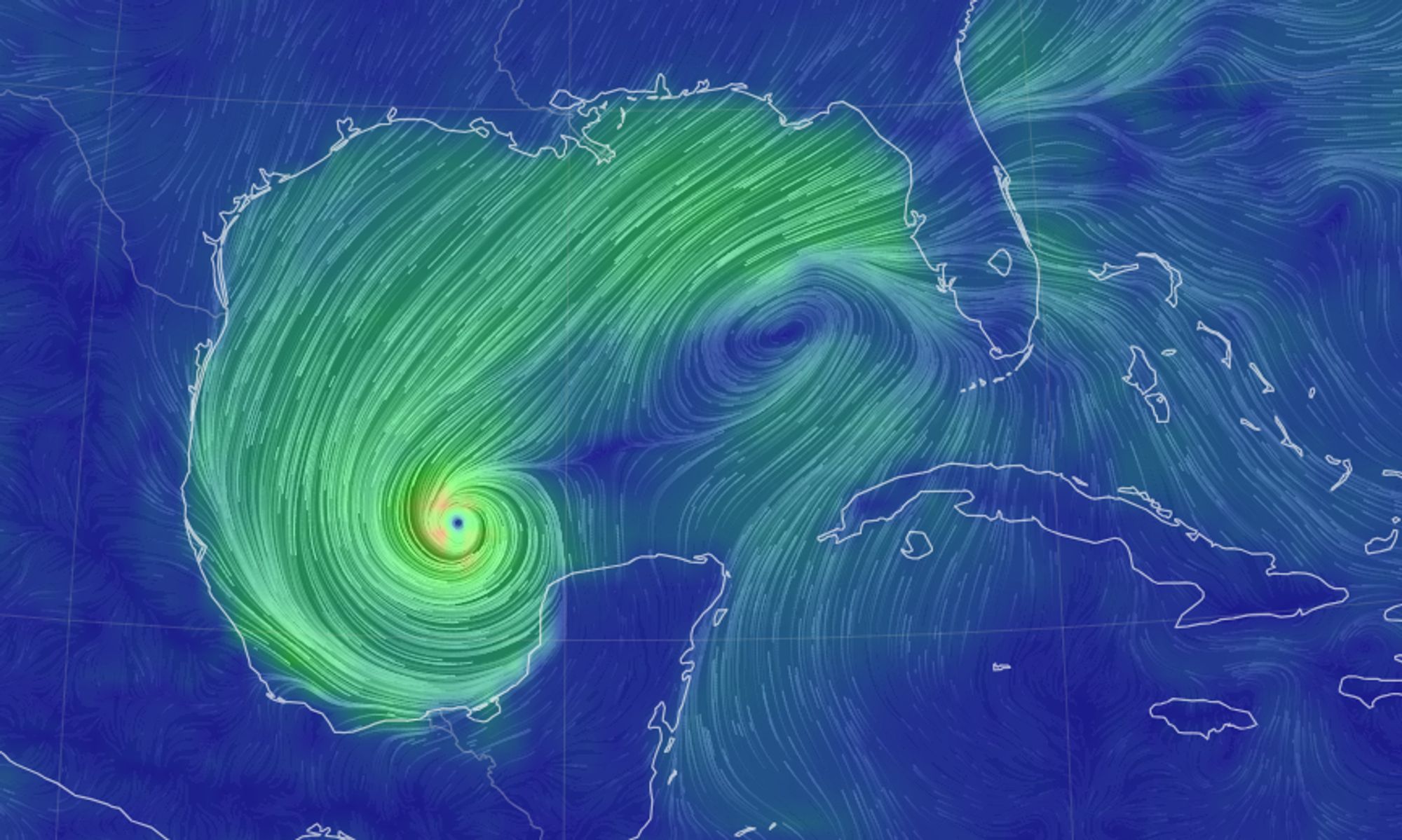

European gas prices have been marching upwards in recent days (largely against mine and I would charitably say a fair few analyst's expectations). Obviously a few reasons (Norwegian shutdowns slow to finish, N.African pipeline slow) but look, totally normal conditions where most US LNG comes from:

That is obviously fantastic, and what makes it better is the way the presenter is dressed, and the set, makes it look like it might be going out on children's TV. A lot of bemused five year olds in Germany.

While that is true, what is actually also key to show, and I forgot to mention, is cooling demand. Soaks up masses of the peak PV especially.

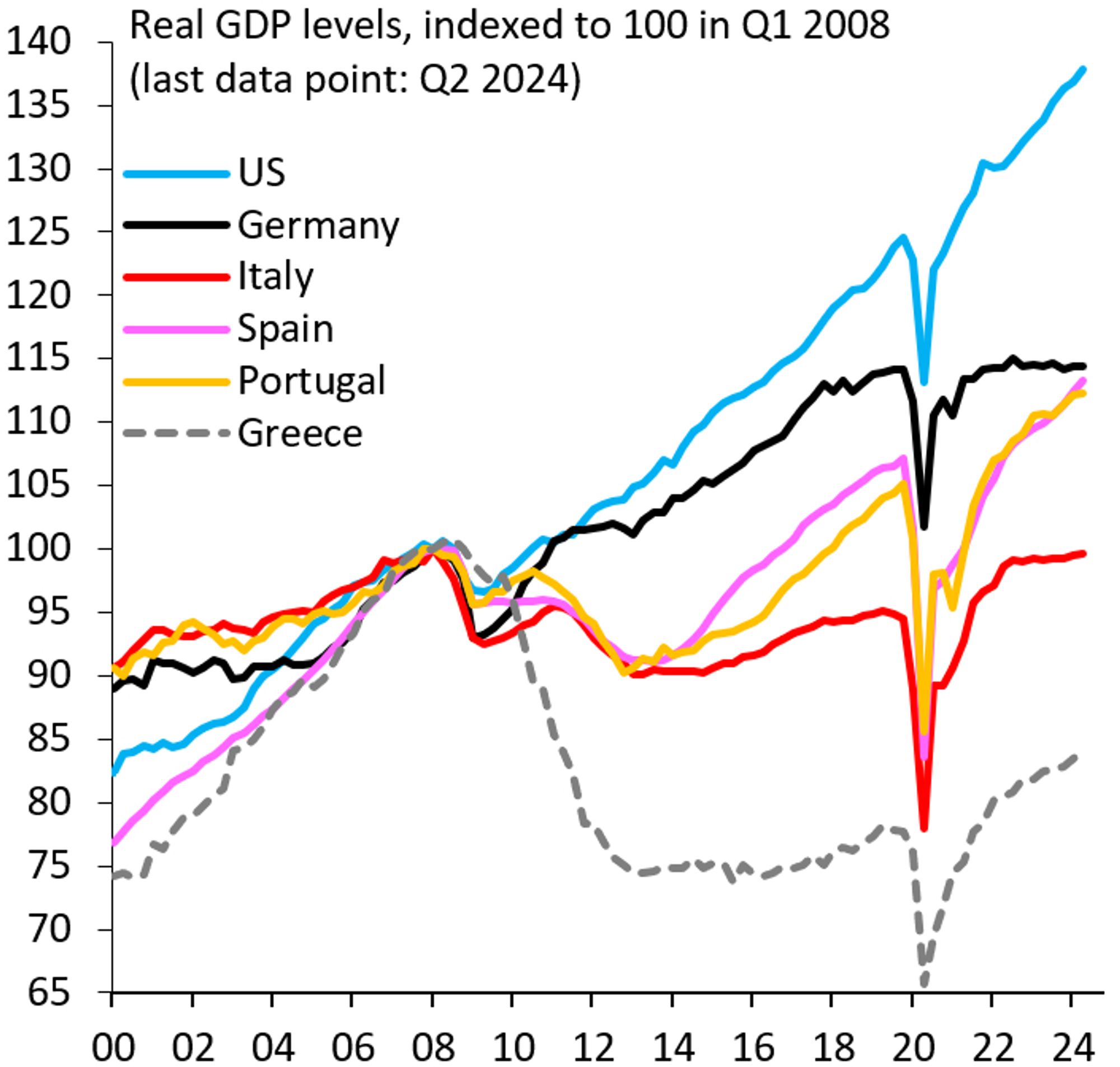

Of course means Spain will be hitting the renewables integration problems harder than most (negative pricing, peaky times during cold weather etc), but watch out for it becoming a hot bed for things like e-methanol production and the like - a whole new industry to power GDP.

It's the model the UK went/is going for, but unfortunately gas is just too central to the economic model currently (will slowly change). Spain doesn't have the millstone of wide spread gas residential heating for example which means cheap electricity hits home harder and faster.

Spain (and Portugal by market integration), is currently sitting in a world class energy position: absolutely rampant renewable deployment and *masses* of spare LNG import infrastructure to pick up cargoes whenever they are cheap. Best of both worlds.