BM

Bakou Mertens

@bakoumertens.bsky.social

Econ PhD student @Ghent University.

Working with firm-level data on corporate finance without the self-serving blinds.

=> Corporate financialization, inequality and climate, but Interested in macro in general. Blogging at bakoumertens.quarto.pub

23 followers92 following4 posts

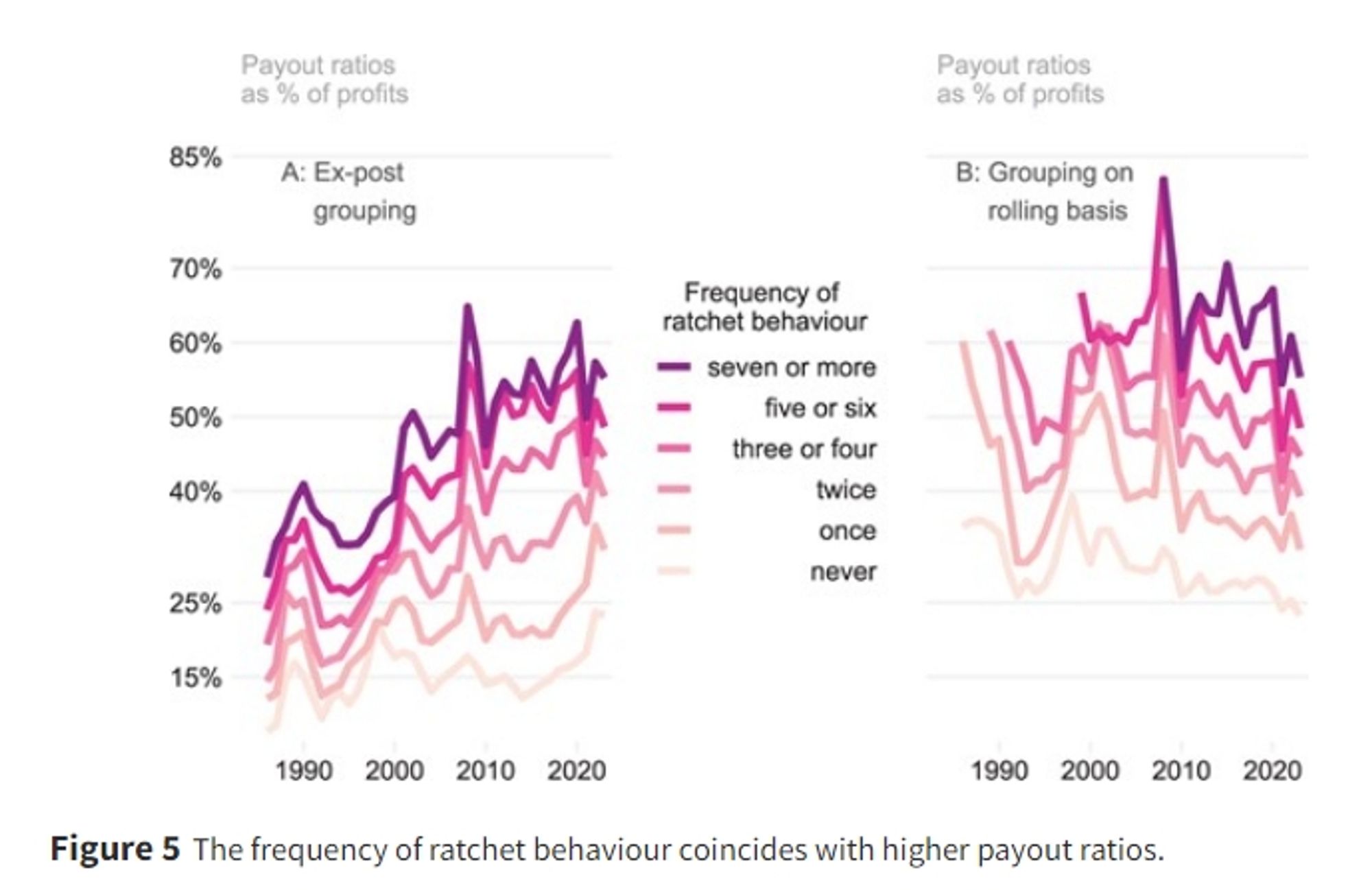

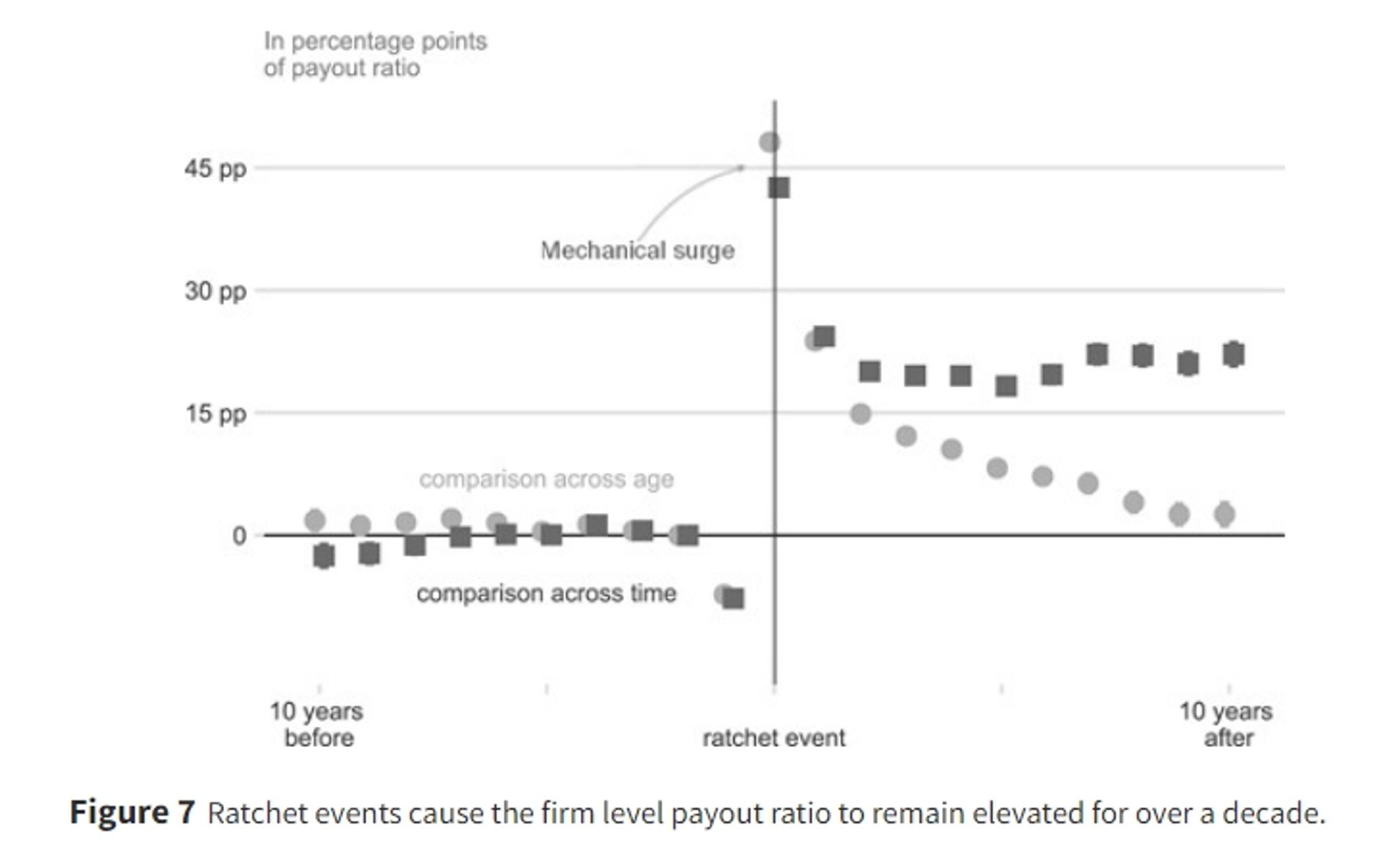

Short summary: bakoumertens.quarto.pub/bakoumertens... People tend to focus on large increases in dividends or share repurchases (payouts), but I show that it is not rising payouts that should attract our attention, but rather their inability to fall.

Payouts fractionally adjust upwards in good times but are downward rigid in bad times - just like a ratchet. 1) Aggregate payout ratios are structured along the frequency of ratchet behaviour 2) At the firm level each ratchet event persistently raises the payout ratio for a decade (staggered DiD)

BM

Bakou Mertens

@bakoumertens.bsky.social

Econ PhD student @Ghent University.

Working with firm-level data on corporate finance without the self-serving blinds.

=> Corporate financialization, inequality and climate, but Interested in macro in general. Blogging at bakoumertens.quarto.pub

23 followers92 following4 posts