This likely has real consequences. When firms maintain stable payouts despite declining profits, they must either resort to cutting investments, R&D expenditures, or labor costs or to taking on higher levels of (unproductive) debt.

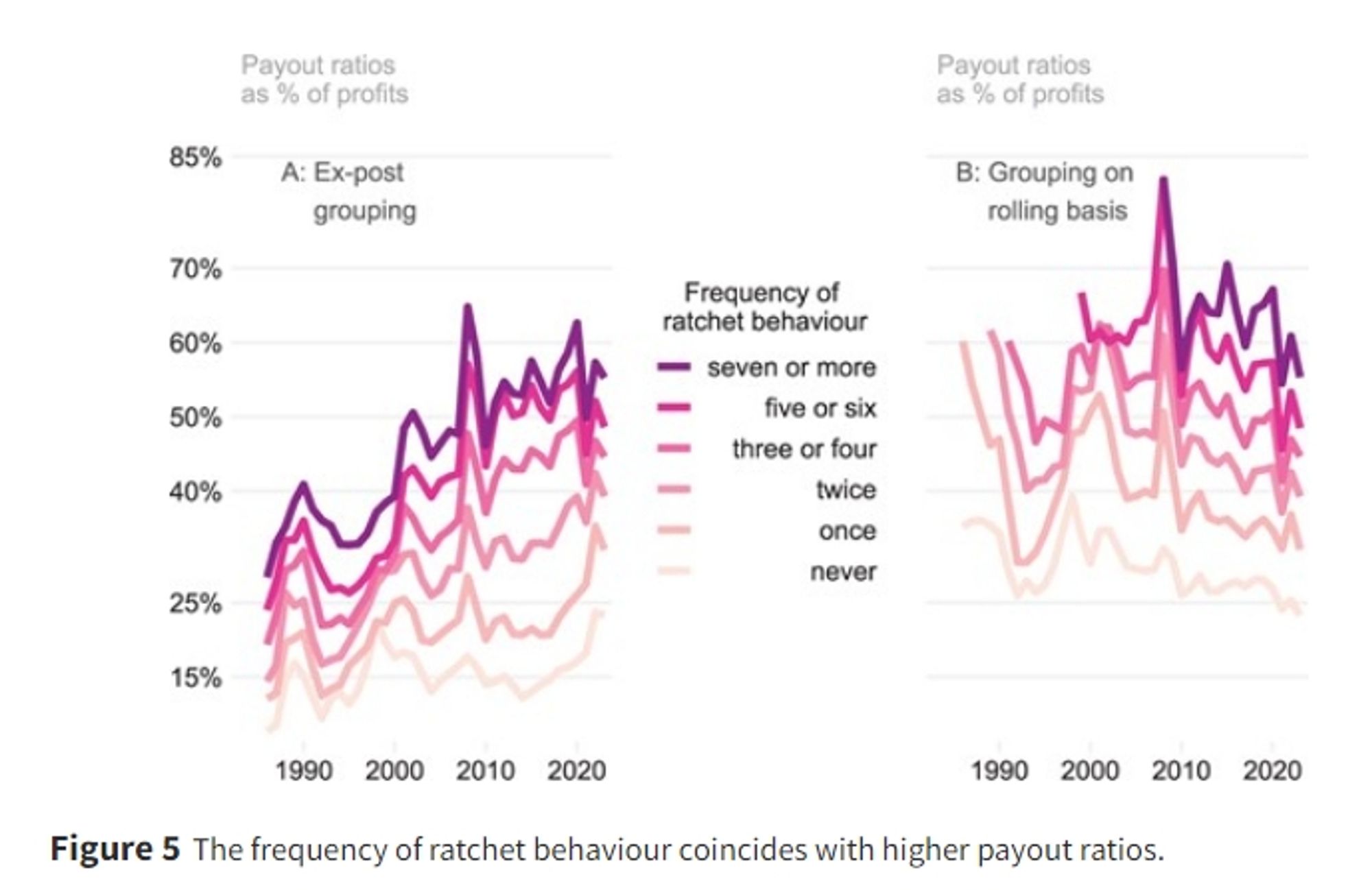

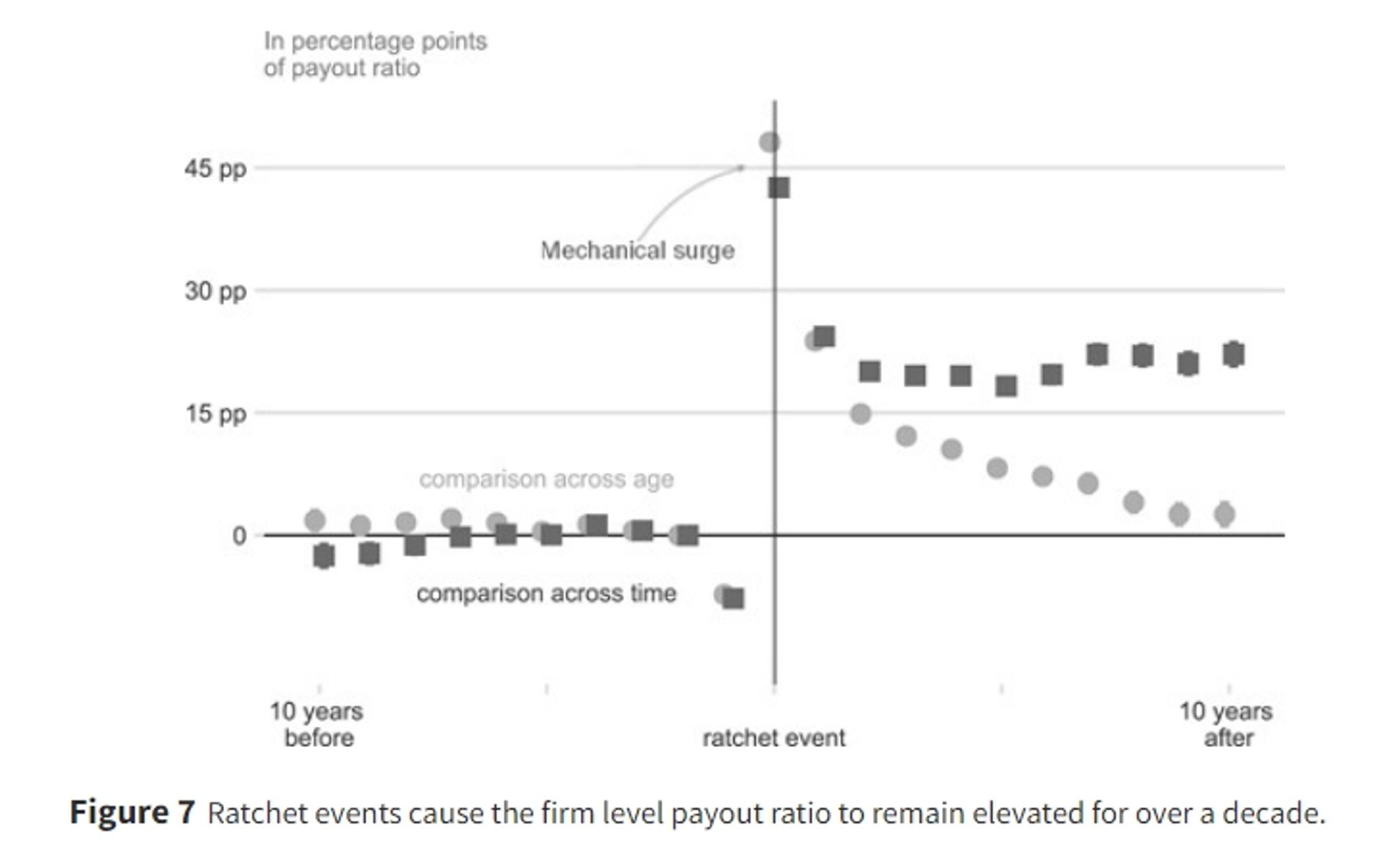

Payouts fractionally adjust upwards in good times but are downward rigid in bad times - just like a ratchet. 1) Aggregate payout ratios are structured along the frequency of ratchet behaviour 2) At the firm level each ratchet event persistently raises the payout ratio for a decade (staggered DiD)

Short summary: bakoumertens.quarto.pub/bakoumertens... People tend to focus on large increases in dividends or share repurchases (payouts), but I show that it is not rising payouts that should attract our attention, but rather their inability to fall.