Fantastic to see this out! In our O/A article with @jcgraz.bsky.social@ejir.bsky.social, we draw on Frank Knight’s analysis to explain how international actors claim reliable knowledge for shaping future states of the world in times of crisis. A short 🧵 1/9

Via infoclio: Les apôtres du marché : acteurs et réseaux suisses du néolibéralisme international (1969-1995) www.infoclio.ch/de/les-apo%C...

Christian Ebner und Daniela Rohrbach-Schmidt untersuchen anhand von über 9000 Interviews und über 45.000 Prestigebewertungen das Ansehen von Berufen in Deutschland. Abrufbar unter: www.degruyter.com/document/doi...

To most, that price tag probably sounds absurd. But "in the minds of many, Harvard, Stanford, and Yale are analogous to Louis Vuitton, Ferrari, and Hermès." That's what these parents are buying for their kids--a luxury brand. (www.cambridge.org/core/books/a...)

I started reading this and had to stop. It made me quite unwell.

Elite educational consultants are charging parents upwards of $120,000 a year to coach their kids into Ivy League schools by curating their extracurriculars, helping them land internships, craft essays and more

For $120,000 a year, Christopher Rim promises to turn any student into Ivy bait.

‼️Publication alert! After 6 years of intense research, our paper "Fast and Curious" has been published in Review of Political Economy (ROPE) ! With Guillaume Vallet, we explore the institutional roots of organised capitalism in Switzerland from the 1880s onwards. Highlights ⬇️

We are delighted to announce that our conference this year will take place at the University of Sheffield, UK, September 12-13. Keynotes speakers have been confirmed (Dick Bryan, Julie Froud, Matthias Thiemann) and the call for papers is now open! financeandsocietynetwork.org/finandsoc-co...

Are you interested in Elites, Power and Inequalities? Join us from 16 - 21 June 2024 at the @obelitessuisses.bsky.socialwww.unil.ch/summerschool...

Lugano soll zum Kryptoparadies werden. Mittelsleute von umstrittenen Konzernen bauen dafür gerade die Infrastruktur auf. Die Stadtverwaltung unterstützt das. Was läuft da ab? – Jetzt auf republik.ch.

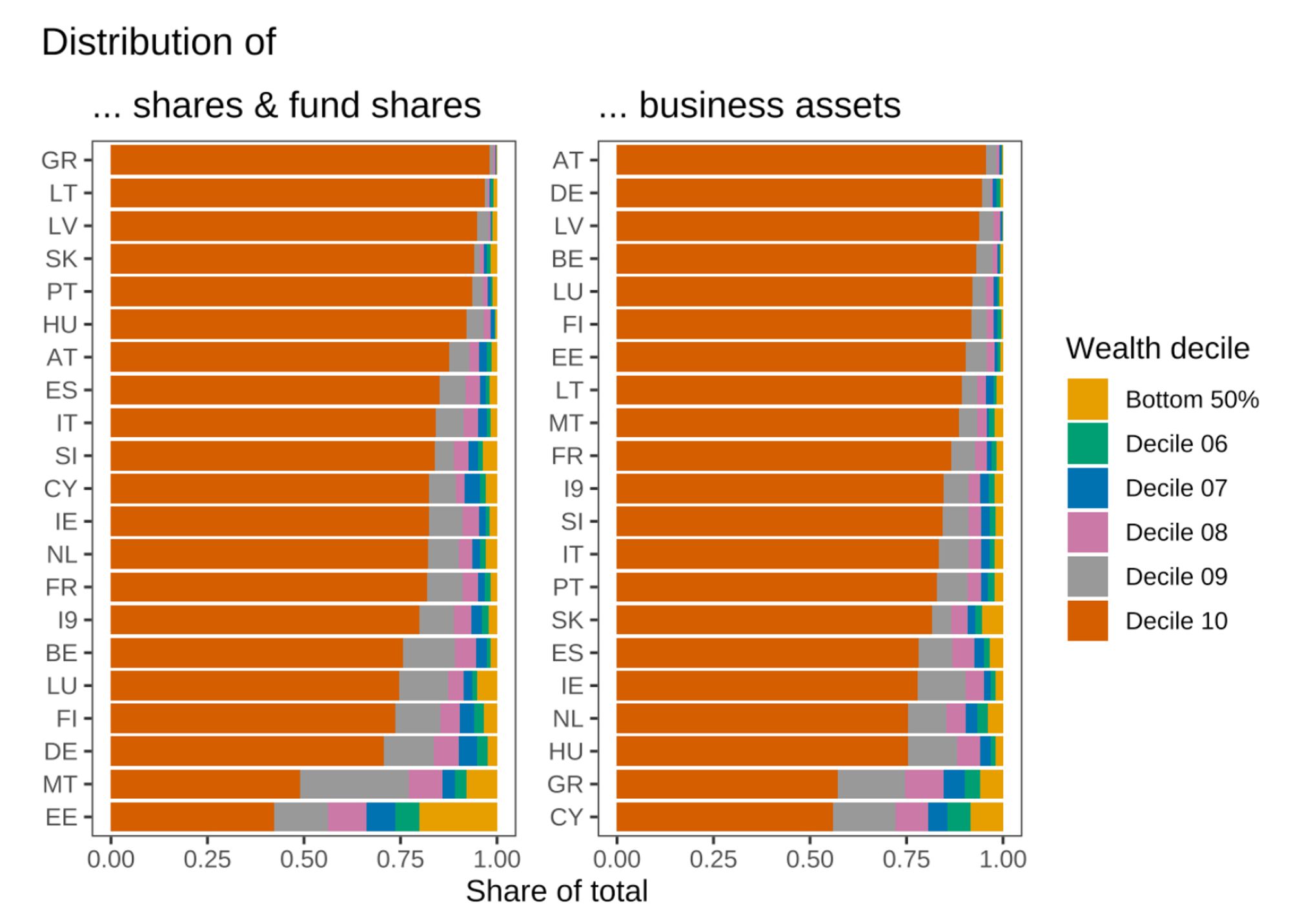

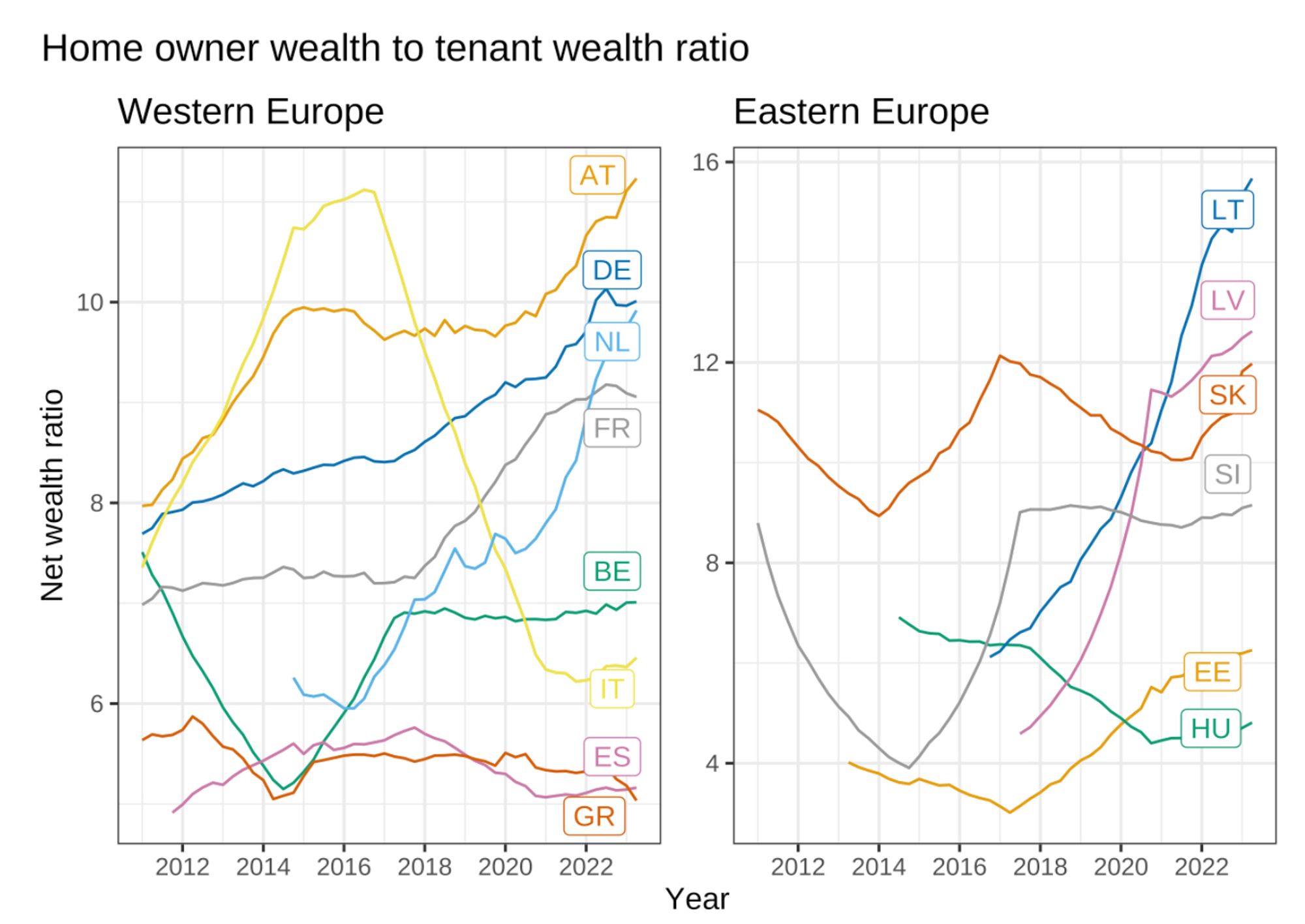

I wrote a post about the ECB's new distributional wealth accounts, which are a big deal. It explains what DWA are and shows what researchers can do with them. Highlights: - very unequal distribution of shares & business assets - massive home-owner/tenant wealth gap 1/3 benjaminbraun.org/posts/dwa/